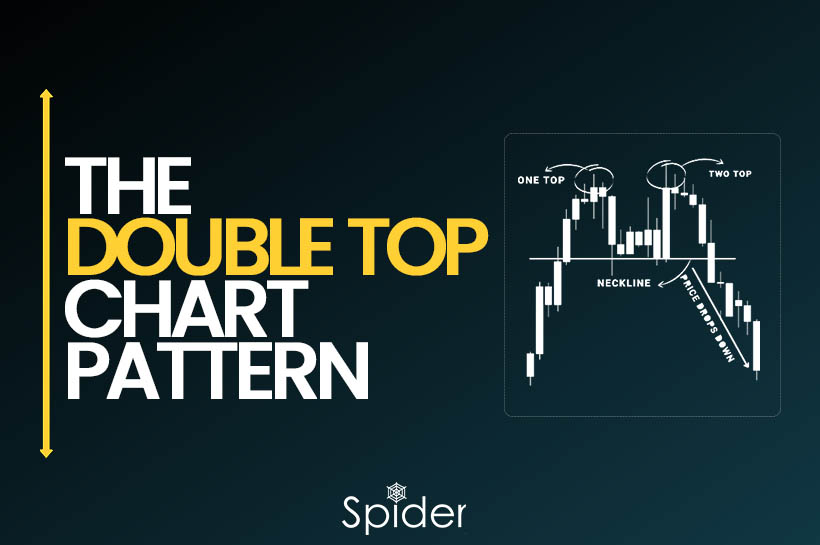

A double top pattern is a bearish reversal pattern that forms after an extended uptrend.

What is Double Top Pattern

The double top pattern is a bearish reversal pattern that typically occurs after a prolonged uptrend in financial markets. This pattern is formed when the price of an asset rises to a high level, then falls back, rallies to a similar high, and then declines again. The two peaks of the pattern should be close to the same price and be separated by a trough.

Traders and investors often view the double top pattern as an indication that the uptrend is losing momentum and may be reaching its end. This pattern is commonly used to identify selling opportunities and manage risk.

How to use Double Top Pattern

Potential Trend Reversal: The Double Top pattern is a technical chart pattern that can signal a potential trend reversal. If a Double Top pattern forms, it suggests that the price of an asset has twice reached a resistance level and failed to break it. This could indicate that the uptrend is weakening and a bearish reversal could be on the horizon.

Confirming Trend Reversal: The Double Top pattern can confirm a potential trend reversal when used in conjunction with other technical indicators. For instance, a bearish divergence between the price of the asset and the momentum indicator, such as the Relative Strength Index (RSI), could support the signal of a Double Top pattern and further confirm the bearish trend.

Risk Management: If you identify a Double Top pattern forming, you can use it to manage your risk by setting a stop-loss order below the confirmation line or neckline of the pattern. This could help you limit your potential losses if the trend does indeed reverse.

Combination with Other Patterns: You can use the Double Top pattern with other chart patterns to gain more insight into the market. For example, you could look for a Double Top pattern forming within a larger Head and Shoulders pattern, which could suggest a more significant trend reversal. However, it’s essential to note that no single indicator or pattern is entirely reliable, and it’s necessary to use a combination of them to make informed trading decisions.

Placing Stops and Taking Profits in Double Top Pattern

Placing stops and taking profits are important aspects of trading the Double Top pattern. When using the Double Top pattern to manage your risk, it’s advisable to place your stop-loss order below the confirmation line or neckline of the pattern. This level is where the price broke the support level and confirmed the Double Top pattern. By placing your stop-loss order below this level, you can limit your losses if the price breaks below the neckline and confirms the bearish reversal.

To take profits when using the Double Top pattern, you can use several methods. One common approach is to measure the distance between the highest peak of the pattern and the neckline, and then subtract that distance from the neckline to determine the potential target price. Another method is to use a trailing stop and let the profits run until the price reaches a significant support level or shows signs of reversal. Additionally, you can use other technical indicators, such as Fibonacci retracements or pivot points, to determine your profit targets.

It’s important to note that there is no one-size-fits-all approach when it comes to placing stops and taking profits in trading. You should always consider your risk tolerance, trading goals, and overall market conditions when making these decisions. Additionally, it’s crucial to practice good risk management by diversifying your portfolio, using stop-loss orders, and never risking more than you can afford to lose.

Double Top Chart Pattern on Bank Nifty in 15 min Charts

The Double Top chart pattern was observed on the Bank Nifty’s 15-minute time frame, and it turned out to be a successful pattern, providing traders with a decent profit. Traders who identified the pattern’s potential trend reversal and managed their risk by placing a stop-loss order below the confirmation line or neckline of the pattern were able to benefit from the downward price movement that followed. By taking advantage of the Double Top pattern and combining it with other technical indicators or chart patterns, traders can gain valuable insights into the market and make informed trading decisions.

Bajaj Finserv can form Double Top in 15 min Charts.

If this type of candle is formed in bajaj finserv 15 min chart and the next candle break the low of that of that candle it will form double top .

Disclaimer:

The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein

Recent Comments on “Most Profitable Double Top Chart Pattern”