More people are trading stocks online to save on advisor fees. It’s crucial to know the two main ways to trade: Intraday and carry-forward. Plus, there are different order types to learn about.

Many people are now using the internet to buy and sell stocks themselves instead of paying advisors big fees. But before you start, it’s important to understand the different ways you can place orders for trading.

In Intraday trading, you close your positions on the same day. In carry-forward trading, you either take delivery of the stocks or keep your position for a later date, like in Futures and Options. There are also various types of orders you can use for trading.

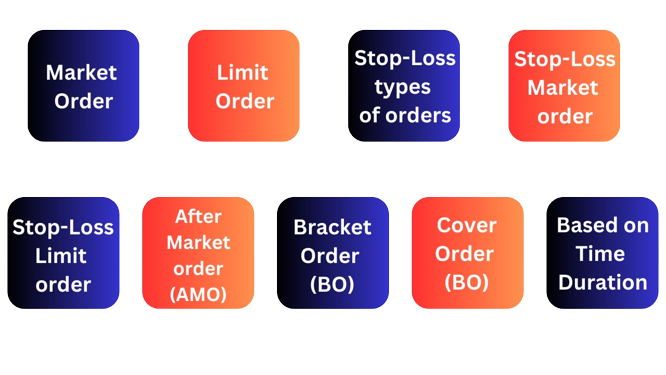

Different Types of Orders

Market Order

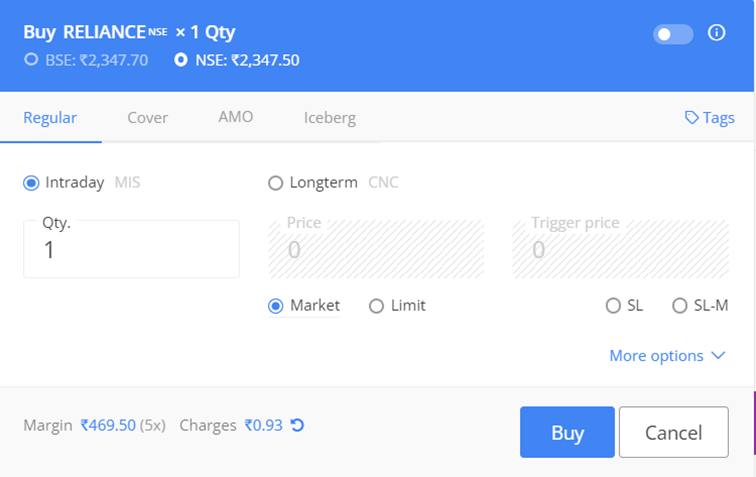

A Market Order is the most straightforward type of trading instruction. It involves buying or selling a security at the best available price in the current market conditions.

When you place a market order to buy or sell, the system promptly carries out the transaction using the most favourable prices available at that moment.

In this type of order, you don’t have the ability to specify a particular price, but there is a very high changes that the order will get executed.

Limit Order

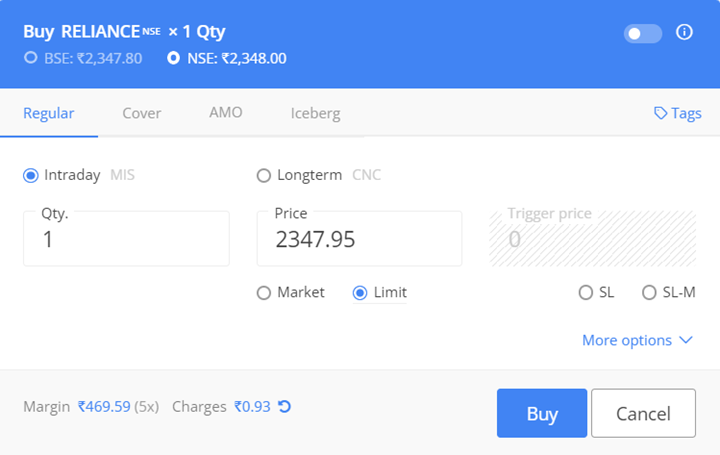

A limit order, also called a pending order, lets you decide on a specific price at which you want to buy or sell stocks in the future. This order only goes through if the stock’s price reaches the level you’ve set. If the price doesn’t reach that point, the order won’t happen. Essentially, a limit order sets the highest price you’re willing to pay when buying or the lowest price you’re willing to accept when selling.

Stop-Loss Order

A stop-loss order is a crucial tool for traders to prevent big losses. It works like this: when you buy a stock and hope its price goes up so you can make money, sometimes the price goes down instead. To protect yourself from losing too much, you can set a stop-loss order at a price below what you bought the stock for. If the stock’s price falls to that level, the order automatically sells it, limiting your losses. It’s like a safety net for your investments.

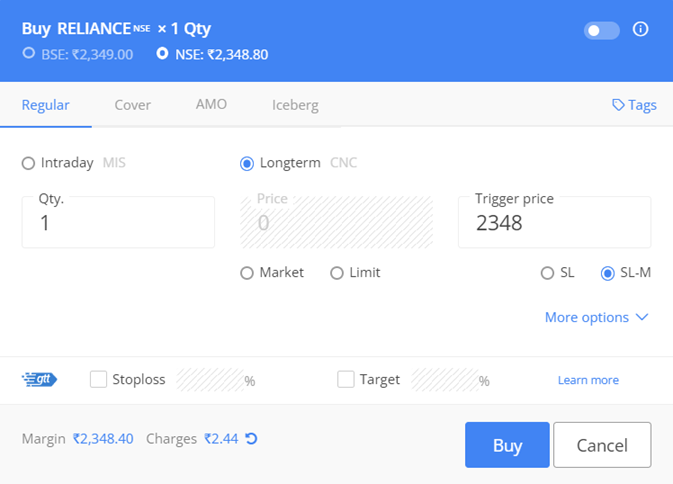

Stop Loss Market Order

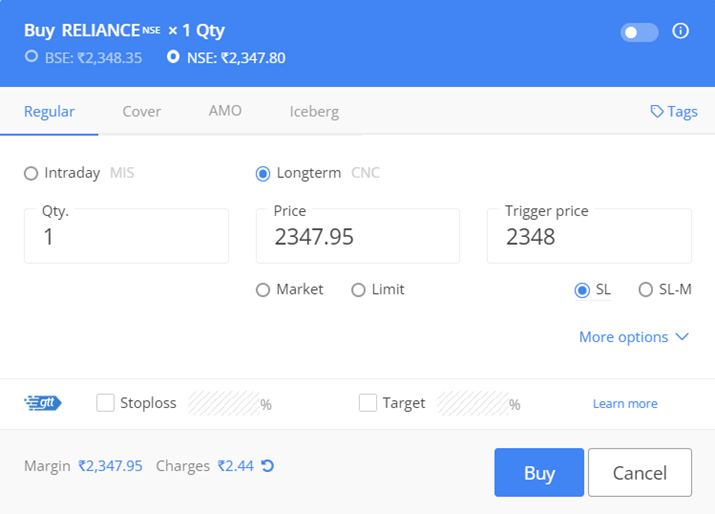

A stop loss market order, often referred to simply as a stop loss order, is a specific form of protective order in trading. In this type of order, when the trigger price is reached, it transforms into a market order automatically. When setting up a stop loss market order, you only need to specify the trigger price.

Once you place an order, you can’t change its price. When the trigger is hit, the order gets executed at the current market price, ensuring it’s filled at the best available price at that time.

Stop Loss Limit Order

A stop-loss limit order is same like a regular stop-loss order, but with a twist. It won’t automatically sell your stock at the current market price. Instead, it will only sell if the stock hits a certain price that you set in advance. This means you have to decide two things: the price that triggers the sale (trigger price) and the lowest price you’re willing to accept (limit price).

Example: Imagine you own a stock at a price of 50, & you want to protect your investment with a stop-loss limit sell order:

Your long position is at a price of 50.

You set a stop-loss limit price at 48.

The trigger price is set at 49.

If the stock’s price drops to 49, it will activate the sell order at 48. If the stock price keeps dropping and hits 48, your order will go through, which helps you prevent bigger losses.

After Market Order (AMO)

“After market orders,” or AMOs, are orders you submit when the regular market trading hours are over. Typically, standard market hours span from 9:15 AM to 3:30 PM, but it’s important to note that the entire time outside these hours may not be available for placing AMOs.

Different brokerage firms establish specific time windows during which clients can enter AMOs. These time windows can vary from one broker to another.

Additionally, there are specific rules regarding the price levels you can set in limit orders for After Market Orders (AMOs). Usually, these limits fall within a range of 5% to 10% of the adjusted closing price of the security, though the exact range might differ among brokers.

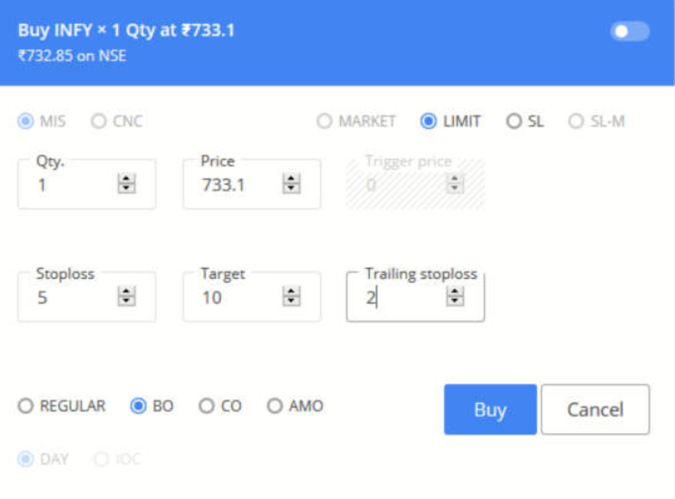

Bracket Order (BO)

A bracket order is a specialized order type primarily used in intraday trading. It involves the simultaneous placement of a buy order along with associated stop-loss and target orders. Bracket orders are created to help traders close their positions in a favorable way before the trading session ends. However, the ultimate outcome of such orders hinges entirely on the trader’s choice of stock, as well as their selection of appropriate stop-loss and target levels.

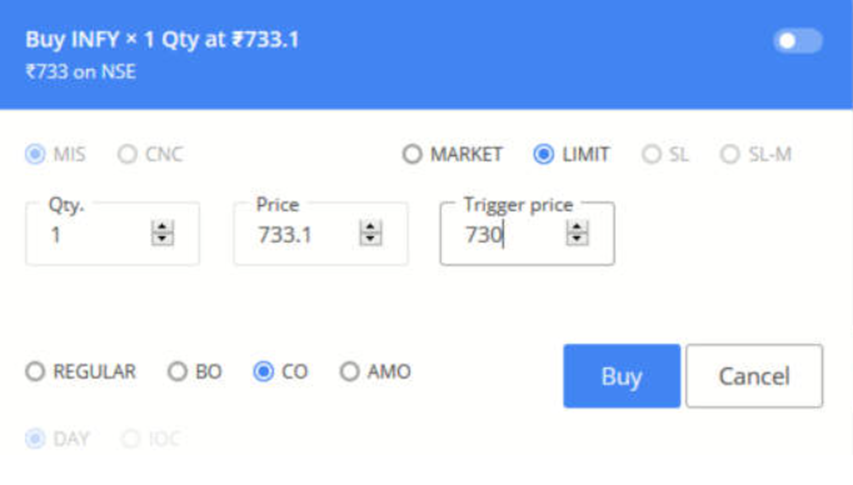

Cover Order

A cover order is a type of trading order that allows you to both open a position and set a stop-loss level in a single order.

Based on Time Duration

In the stock market, there are different types of orders based on how long they last:

Good For Day Order: This order is only active for one day, from the opening to the closing of the trading day. If it doesn’t get executed during that day, it’s cancelled.

Good Till Day Order: With this order, you can keep it active for a few days, not just one. If you put in an order and it doesn’t happen immediately, you can let it stay active for a few more days to see if it gets executed before it’s cancelled.

Immediate or Cancel Order

This type of order in the stock market. When you place this order, it tries to buy or sell something right away. However, if it can’t buy or sell everything you want immediately, it cancels the part of the order that couldn’t be completed. So, sometimes, you might only get part of what you wanted to buy or sell.

Also, Check our Article on Zero to Hero Option Trading Strategy (80% ACCURACY) – 2023

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein.