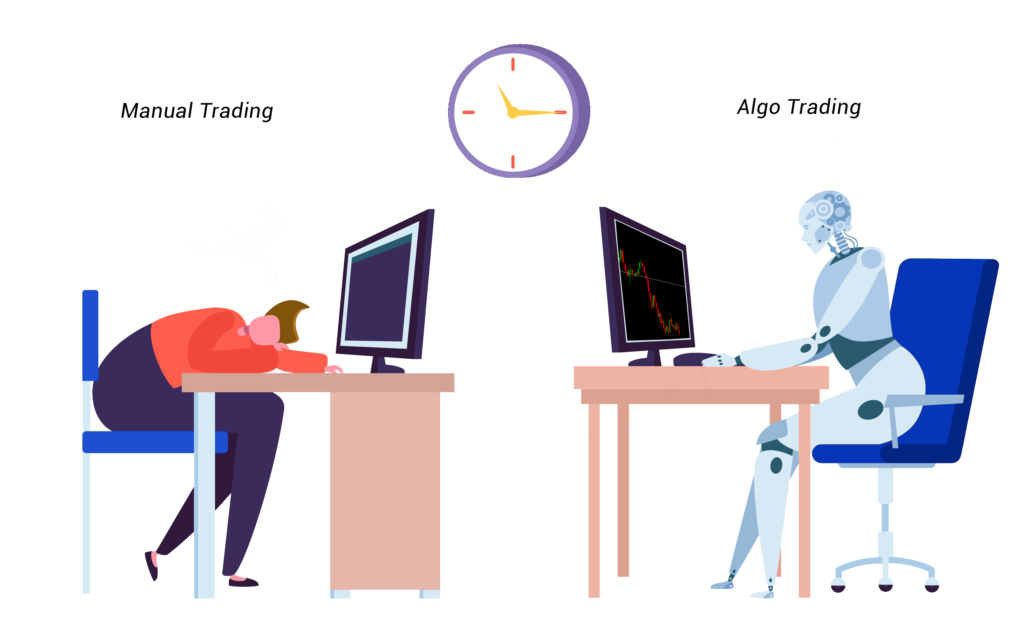

In recent years, algo trading has become a popular alternative to traditional manual trading in the financial world. However, it can be confusing to decide which trading method to use. While manual trading has been the standard for a long time, algo trading is a newer approach. To determine which method is right for you, it’s important to understand the differences between them and consider your personal trading style and preferences.

Manual Trading

Manual trading is where a trader will make a decision on when to buy or sell an asset and then place the trade themselves via market or pending orders. The manual trader also scan multiple markets first to actually find an opportunity before deciding to act.

Advantages of Manual Trading

Flexibility

Traders gets flexibility in terms of strategy and decision-making. Traders can adjust their approach based on changing market conditions, which is not possible in algorithmic trading.

Intuition

Manual trading allows traders to rely on their intuition and experience to make best decisions.

Cost

Manual trading can be less expensive as compare to algo trading, as it does not require specialized software and technical expertise.

Disadvantages of Manual Trading

Inaccuracy

Manual trading may not always be as accurate or consistent as algorithmic trading since it relies on human analysis and predictions. which can be influenced by biases and mistakes.

Time

In manual trading trader requires more time to analyse market, fundamental & execute. It will be difficult for working professional.

Emotions

Manual trading can be influenced by emotions, which may affect a trader’s judgment and lead to making poor decisions.

Algo Trading

Algorithm trading is when computer programs automatically execute trades based on pre-set rules and analysis of historical data. This type of trading is gaining popularity among institutional investors and hedge funds who have access to advanced software and technical knowledge.

Advantages of Algo Trading

Accuracy

Algorithmic trading uses math models and historical data analysis to be more accurate & consistent.

Time

Algo trading can be done automatically & requires less time & attention.

Risk Management

Algo trading can help reduce risk by using advanced techniques to automatically manage trades.

Stop Loss

An advance order to sell an asset when it reaches a particular price point. It is used to limit your losses.

Disadvantages of Algo Trading

Cost

Algo trading can cost more than regular trading because it needs special software and expertise.

Inflexibility

Algo trading follows predetermined rules and criteria, which may restrict flexibility in strategy and decision-making.

Failures

Algorithms can fail or produce unexpected results, which can lead to significant losses.

Conclusion

Both algo trading and manual trading have advantages and disadvantages. Manual trading offers flexibility and relies on intuition and experience. Algo trading is more precise, consistent, and reduces risk. Choosing the right method depends on your goals, experience, and resources. Understanding the differences helps you make an informed decision for success in the stock markets.

Check out our Blog on Understanding Hedging Strategy to Manage Stock Market Risks

Don’t miss out on our Upcoming Master-Class on Learn & Trade Live on Expiry Day.

Register now and take your Trading game to the next level. *Click Here To Register*

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein.