Reliance Industries will have Jio Financial Services holding 413 million treasury shares, accounting for 6.1% of its outstanding shares.

The Reason for Demerger?

Reliance Industries demerged to create Reliance Strategic Investments Limited also known as Jio Financial Services (, focusing on Financial Services Business. This move aims to enhance management focus and operational efficiency in the financial services sector while providing investors with clear insights into individual business performances. Furthermore, the demerger can positively impact market perception, leading to increased investor interest in both RIL and RSIL.

The demerger of Reliance-JFSL.

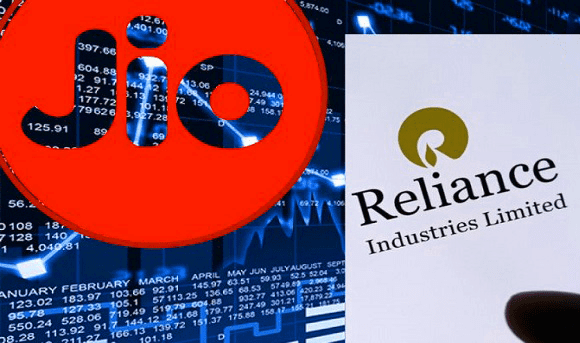

RIL board announces acquisition cost for RIL and RSIL before demerger. According to the latest exchange filing, after the demerger, the cost of acquisition for Reliance Industries Ltd would be 95.32%, while Reliance Strategic Investments Limited would hold the remaining 4.68%.

Jio Financial Services (JFSL) shares traded at Rs 261.85 per share during a pre-open call auction session on NSE. Considering the demerger, the share price of Reliance Industries (RIL) declined to Rs 2,580.

The Approvement of the Scheme

NCLT, Mumbai Bench, approved the Scheme of Arrangement between RIL, its shareholders, creditors, and RSIL, its shareholders, and creditors. The scheme includes the demerger, transfer, and vesting of the Financial Services Business from Reliance Industries Limited to RSIL on a going-concern basis. RSIL will issue equity shares to the shareholders of Reliance Industries Limited as part of the arrangement, in accordance with the provisions of Section 2(19AA) of the Income Tax Act, 1961.

What is the Cost of Acquisition look like for the Entity?

The constant price for JFSL was determined by subtracting RIL’s Wednesday closing price from the price derived during today’s special pre-open session.

NSE will include Jio Financial in various indices like Nifty50, Nifty100, Nifty200, Nifty500, and more on a temporary basis. After market hours on Wednesday, the exchange will create a dummy symbol for Jio Financial and add it to the applicable indices. Jio Financial will remain part of these indices at a constant price until it is officially listed on the exchanges.

Is the Demerger Beneficial for the Investors?

The demerger of Reliance Industries (RIL) into Reliance Strategic Investments Limited (RSIL) can benefit investors. It creates focus and efficiency in the financial services sector, provides clarity on each business’s performance, and improves market perception. Investors get diversification opportunities and can make informed decisions. Professional advice and research are essential for wise investment choices.

To Summarize.

In summary, Reliance Industries Limited demerged its Financial Services Business to create Reliance Strategic Investments Limited (RSIL) as a separate entity. The National Company Law Tribunal, Mumbai Bench, approved the Scheme of Arrangement, allowing for the demerger and issuance of equity shares by RSIL to the shareholders of Reliance Industries Limited. The demerger was sanctioned in accordance with the Income Tax Act, of 1961.

Learn how utilizing the Momentum Strategy can boost your intra-day trading skills and elevate your trading abilities. Click Here To Register

Also, if you want to how Triple Top Pattern is formed in the Stock Market? Click Here To Know

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein.