Factors that will fuel stock market are BJP’s strong show in state elections , Positive global cues, Hopes of peaking interest rates, A return of FIIs

The market witnessed a positive opening on December 4, with both the benchmark Nifty 50 and Sensex reaching new highs. Investors expressed enthusiasm over the BJP’s significant victory in three Hindi Heartland states, seen as a positive signal for political stability and a reduction in concerns about populism.

As of 9:30 am, the Sensex had surged by over 1,000 points, equivalent to 1.5 percent, reaching 68,525. Simultaneously, the Nifty experienced a gain of more than 300 points, or 1.5 percent, reaching around 20,600. Notably, the Sensex achieved an all-time high of 68,587.82, while the Nifty reached a new peak of 20,602.50 shortly after the market opened. All sectors demonstrated positive momentum, trading in the green.

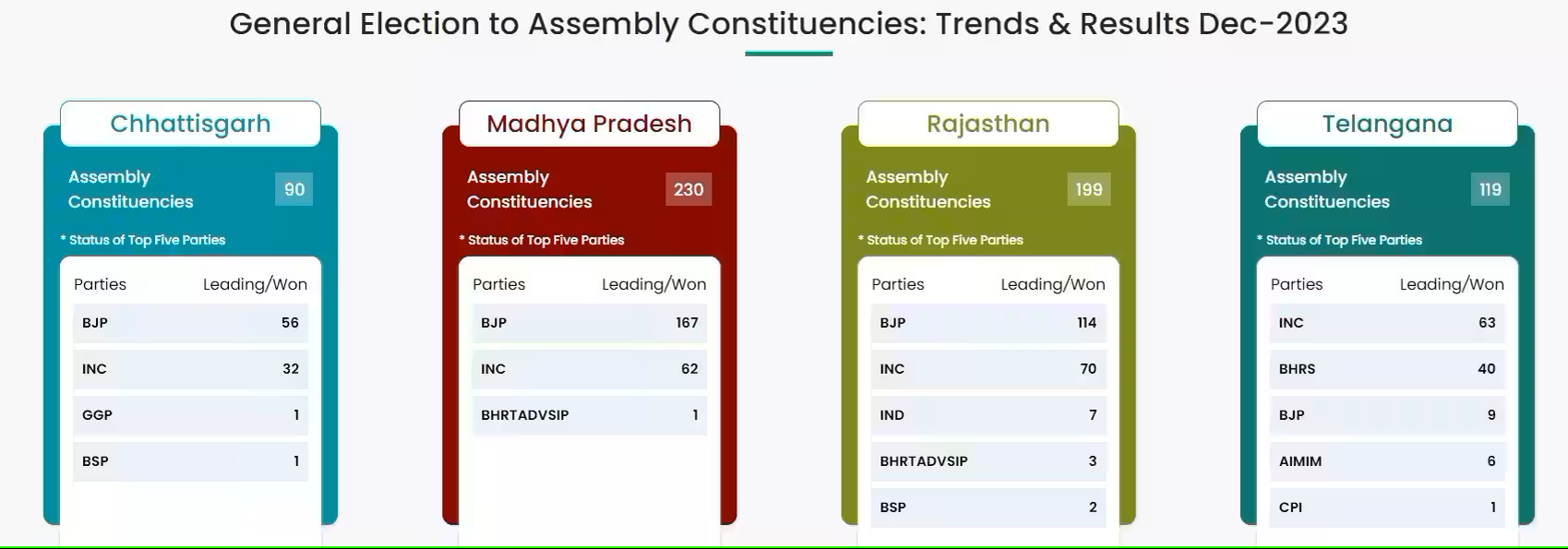

BJP’s big election wins

The BJP’s impressive performance in the recent elections in Rajasthan, Madhya Pradesh, and Chhattisgarh, three of the five states that voted for a new assembly the previous month, alleviated concerns related to fiscal populism and political uncertainties. This contributed to the positive momentum observed throughout the market. In Telangana, the Congress emerged victorious, while vote counting was underway in Mizoram. The outcome of the state elections has emerged as a significant event capable of sparking a renewed sense of optimism and a potential market rally. Investors typically favor political stability and a government that is focused on reforms and market-friendly policies.

Market analysts anticipate robust gains in the domestic market following the election results, and there is widespread optimism among investors that the Nifty could reach the 20,800 mark in the upcoming sessions. According to the brokerage firm Jefferies, the BJP’s success in three crucial states surpassed the predictions of exit polls. Consequently, the election results have strengthened the consensus expectation of a victory for Prime Minister Modi in the 2024 general elections.

Positive global cues

The global scenario was also favorable, as evidenced by significant gains in the benchmark indices in the US on December 1, coupled with incremental increases in Asian markets throughout the day. In addition, a decline in oil prices, the US 10-year bond yield, and the dollar index contributed to the positive sentiment. In light of these factors, Vijayakumar foresees a widespread rally for domestic stocks. “Global markets are currently exhibiting positive sentiment. The cooling off of the US 10-year bond yield and the dollar index adds strength to the market. The impact of these factors on market sentiment will be closely monitored

Interest rate-cut expectations

As indications of inflation cooling down become apparent, investors have factored in the anticipation that the US Federal Reserve will likely halt its rate hike strategy during its meeting on December 12-13. Notably, global market participants are optimistic that the Federal Reserve might initiate rate cuts by mid-2024, further bolstering sentiment. Similar to the Federal Reserve’s expected stance, the Reserve Bank of India is also projected to maintain interest rates during its meeting scheduled for December 6-8.

The return of FIIs

Following three consecutive months of being net sellers, foreign institutional investors (FIIs) made a comeback in late November, engaging in net buying of domestic equities amounting to Rs 5,795.05 crore. This positive trend has persisted into December, with FIIs purchasing equities worth Rs 1,589.61 crore in the initial session of the month. Additionally, the rollover of positions to the December F&O series by FIIs indicates a reduction in short positions and the addition of some long positions. This suggests that the ongoing buying momentum is likely to continue.

Furthermore, explore the Top Bank Nifty Options Strategies., Click Here

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein.