In F&O Trading, you can agree to buy or sell stocks, commodities, or currencies on a specific date in the future at a pre-decided price. It allows you to secure a fixed price for tomorrow’s purchase.

What is F&O Trading?

Derivative trading, commonly known as F&O trading, offers a profitable opportunity for investors to capitalize on the future price fluctuations of various securities. Futures and options trading involves entering into contracts to buy or sell a specific quantity of an underlying security at a predetermined price and date. It is a form of trading where individuals can engage in buying and selling futures and options contracts.

An example of the same is:

Let’s say we have two investors, Mr. Avinash and Mr. Nitesh, who are doing F&O trading. Mr. Avinash wants to buy 100 units of Company A’s stock from Mr. Nitesh after one month for Rs. 200 per unit. Right now, the stock is priced at Rs. 180 per unit, and Mr. Avinash thinks the price will go up later. Here’s the interesting part: If the price goes above Rs. 200, Mr. Nitesh has to sell the stock to Mr. Avinash. But if the price falls below Rs. 180, Mr. Avinash doesn’t have to buy the stock from Mr. Nitesh.

Different Types of F&O Trading

In derivative or F&O trading, there are two main parts: futures and options. They have similarities, but what makes them different is the kind of agreement they involve. Let’s learn more about them.

Future Trading:

In a futures contract, once you agree, you are obligated to fulfill it on the specified date. For instance, let’s say you have a futures contract to buy 50 units of gold for Rs. 50,000 per unit after one month. If, after one month, the market price of gold rises to Rs. 52,000 per unit, you would benefit because you can still purchase it at the agreed price of Rs. 50,000. However, if the market price falls to Rs. 48,000 per unit, you would incur a loss since you are still bound to buy it at the higher price of Rs. 50,000. This showcases the binding nature of futures contracts, requiring both the buyer and seller to fulfill their obligations.

Options Trading:

Options trading is another type of derivative trading where you agree to buy or sell securities at a specific date and price. Unlike futures contracts, option contracts are not mandatory. You have the choice to opt out if it results in a loss. European-style options can only be settled on the contract’s expiration date. Call options are denoted as CE, and put options as PE.

Call Options:

When you have a call option, it means you have the right to buy a specific security at a predetermined price and on a set date. Traders who are optimistic about a particular stock, index, or asset can buy call options to benefit from potential price increases.

Put Options:

A put option gives the holder the right to sell a particular security at a predetermined price and on a specific date. Traders who have a negative outlook on a stock or asset can sell put options to potentially profit from price declines.

What are the main factors to look for when doing F&O Trading

It involves several important factors that traders should consider:

- Volatility: Price fluctuations in the underlying securities impact F&O contracts. Higher volatility can offer more profit potential but also carries greater risks.

- Time Decay: F&O contracts lose value as they approach their expiration date. Time decay refers to this gradual reduction in value over time.

- Strike Price: The predetermined price for buying or selling the underlying security in an F&O contract. It determines potential profits or losses.

- Market Conditions: Economic factors, news events, and market sentiment influence F&O. It’s crucial to analyze market conditions before making trading decisions.

- Risk Management: Implementing risk management strategies, such as setting stop-loss orders and diversifying positions, is essential to mitigate potential losses.

- Liquidity: F&O markets with high liquidity offer better intraday opportunities, easier entry and exit, and improved price discovery.

By understanding these factors, traders can make informed decisions and effectively manage their Future & Options activities.

What are some of the key aspects of F&O Trading

Here are some important aspects that you should know:

- Contracts: Involves contracts for buying or selling securities at a future date and predetermined price.

- Leverage: Allows you to control larger positions with a smaller amount of capital, increasing potential gains and risks.

- Speculation: Provides opportunities to speculate on the price movements of stocks, commodities, and currencies.

- Hedging: F&O contracts can be used to hedge against potential losses in the cash market, providing protection.

- Risk and reward: Carries both potential rewards and risks, offering opportunities for profits but also the possibility of losses.

- Market monitoring: Successful Requires monitoring market conditions, analyzing trends, and staying informed about relevant news and events.

- Options strategies: The Future & Options Trading offers various options strategies, such as buying calls or puts, for customizing risk and reward profiles.

Understanding these aspects of F&O trading is important for making informed trading decisions.

How does the Margin & Premium work in F&O Trading?

Margin and premium are key concepts in F&O trading:

Margin:

In F&O trading, margin refers to the number of funds that traders must deposit with their brokers to initiate and maintain their positions. It serves as collateral and ensures that traders can fulfill their obligations. The margin requirements vary based on the underlying security and market conditions.

Premium:

Premium is the price that traders pay to buy an options contract. It is determined by factors such as the underlying security’s price, volatility, time to expiration, and market demand. The premium represents the cost or the price of the options contract.

Margin is the required deposit, while premium is the cost of options contracts. Traders should manage margins effectively and consider premiums when assessing risks and potential returns in F&O trading.

Benefits of F&O Trading

It gives you leverage, which means you can control bigger positions with less money. This can lead to higher profits. It also lets you hedge, which means protecting your investments from losses in the regular market. Also allows you to speculate and make money from price changes in different securities. It also helps diversify your portfolio by including various assets and trading strategies.

Limitations of F&O Trading

It has higher risks due to leverage and market changes. If the market goes against you, losses can be big. F&O contracts have an expiration date, and as it gets closer, their value can go down. Future & options trading is complex and needs a good understanding of the market and strategies. It also requires maintaining enough margin and watching out for news that can affect the securities.

To sum up

To sum up, F&O trading has its advantages, such as leverage, loss protection, and profit opportunities. However, it also comes with risks due to leverage and market fluctuations. Traders must consider contract expiration and the potential for decreased value. It’s important to understand the market, employ effective strategies, and have sufficient funds. Regular monitoring of market conditions and staying updated with relevant news is essential. By considering these factors, traders can make informed decisions and progress toward their trading objectives.

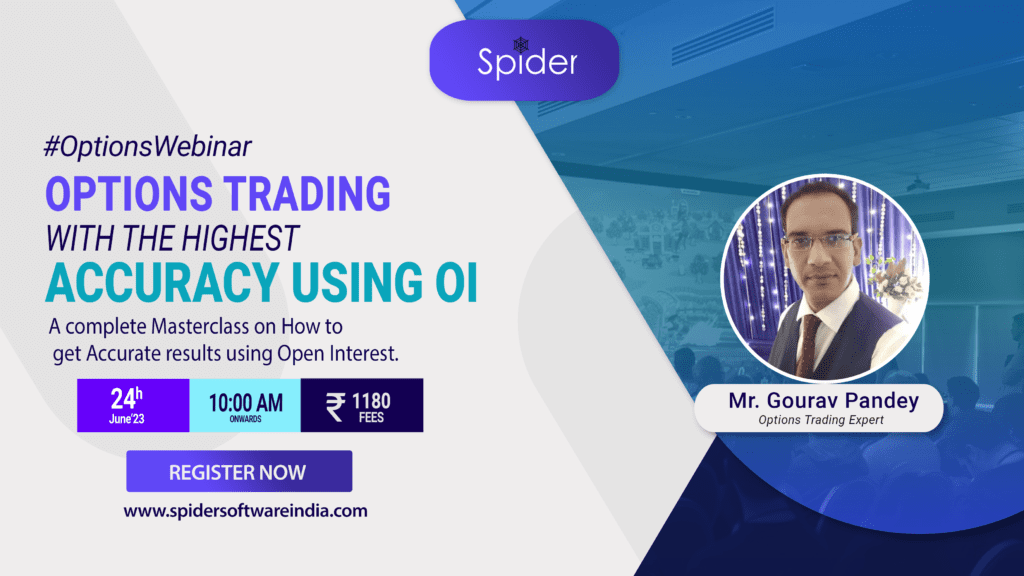

Get a chance to learn how to use Open Interest giving Highly Accurate Options Trading Results.

Also, Check out our article on Beginner’s Guide to Profitable Options Trading.

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein.