In the Stock Market Today, Nifty dips below 22,300, Sensex loses -845 points; banks and IT struggle, oil & gas rise.

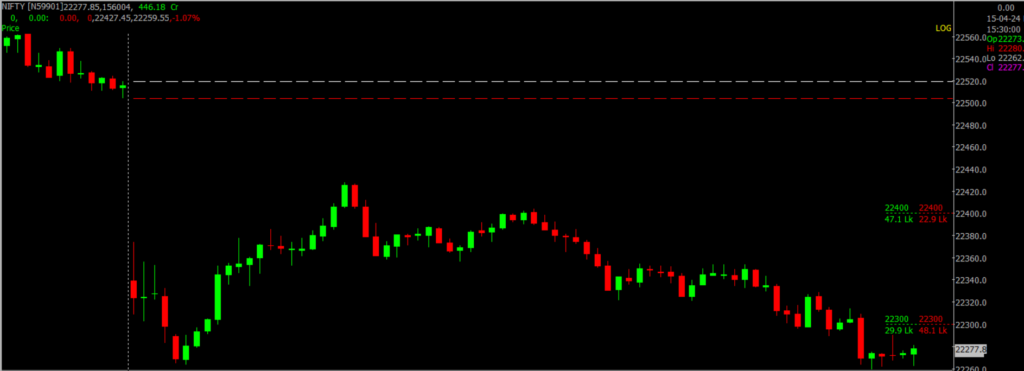

Stock Market Nifty Chart Prediction.

On April 15, Sensex dropped 845.12 points to 73,399.78, while the Nifty fell 246.90 points to 22,272.50. Market activity showed 761 shares advancing, -2,636 declining, and 102 remaining unchanged.

Top Nifty gainers: ONGC, Hindalco Industries, Maruti Suzuki, Nestle India and Bharti Airtel,

Top Nifty Losers: Shriram Finance, Wipro, Bajaj Finance, ICICI Bank and Bajaj Finserv.

All sectoral indices closed in the red, except for oil & gas and metal, which ended positively.

BSE Midcap and Smallcap indices down 1.5% each.

Stock Prediction for 16th April 2024.

| STOCK | Good Above | Weak Below |

| AARTIIND | 743 | 736 |

| JKCEMENT | 4250 | 4225 |

| TATACHEM | 1106 | 1089 |

| UBL | 1860 | 1840 |

Prediction For Tuesday, NIFTY can go up if it goes above 22,450 or down after the level of 22,300 but all depends upon the Global cues.

Nifty started with a gap down and continued to decline, ultimately closing with a significant loss of approximately 242 points. It is currently retracing the recent increase from 22710 to 22776. From a short-term perspective, the new gap range established today between 22450 and 22550 will serve as an immediate obstacle. On the lower side, the 22300 to 22200 range should be viewed as a chance to sell.

| Highest Call Writing at | 22,450 (96.6 Lakhs) |

| Highest Put Writing at | 22,300 (66.0 Lakhs) |

Nifty Support and Resistance

| Support | 22,300, 22,200 |

| Resistance | 22,450, 22,550 |

Bank Nifty Daily Chart Prediction.

Prediction For Tuesday, Bank NIFTY can go up if it goes above 48,300 or down after the level of 47,300 but it all depends upon the Global cues.

Bank Nifty index remains under significant bearish pressure, showing clear selling activity during intraday rallies. It is approaching its support range of 47,300 to 47,400. If it cannot maintain this level, it might face additional drops. Immediate resistance lies between 48,300 and 48,500. Overcoming this barrier decisively is crucial for the index to potentially advance towards the 50,000 mark.

| Highest Call Writing at | 48,300 (38.1 Lakhs) |

| Highest Put Writing at | 47,300 (22.5 Lakhs) |

Bank Nifty Support and Resistance

| Support | 47,300, 47,400 |

| Resistance | 48,300, 48,500 |

Click here to learn the Stocks to Watch as Tensions Between Israel and Iran Escalates.

Join our upcoming free Webinar on Understanding Price Action Techniques: A Guide to Effective Trading

If you’d like to know how we analyze the market and provide accurate levels every day. then click on the Free Demo button below and change your trading life for good. 5X returns are possible in options trading If you have Spider Software in your trading system.

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein.