Nifty closes around 21,250 in today’s stock market, as Sensex drops by 1,053 points; mid and small caps experience a plunge.

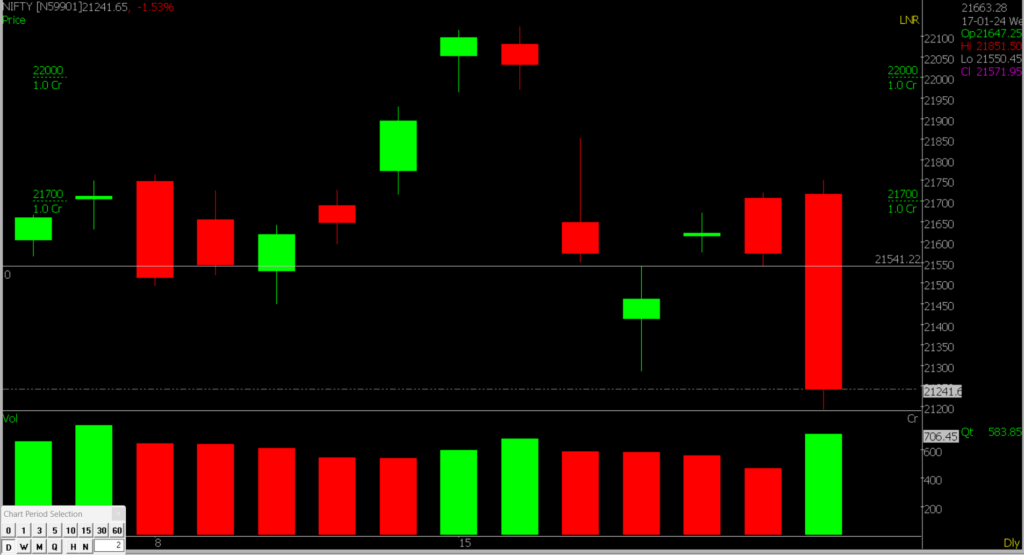

Stock Market Nifty Chart Prediction.

On January 23, benchmark indices concluded the second consecutive session on a lower note, with Nifty hovering around 21,250. The Nifty witnessed major declines from IndusInd Bank, Coal India, ONGC, Adani Ports, and SBI Life Insurance, while Cipla, Sun Pharma, Bharti Airtel, ICICI Bank, and Dr Reddy’s Laboratories emerged as gainers. Across sectors, only pharma remained in the green, with all other sectoral indices trading in negative territory. Both BSE Midcap and Smallcap indices recorded a substantial drop, each falling by nearly 3 percent.

Stock Prediction for 24th Jan 2024

| STOCK | Good Above | Weak Below |

| ASIANPAINT | 3080 | 3052 |

| BHARTIARTL | 1164 | 1145 |

| JUBLFOOD | 523 | 518 |

| LUPIN | 1444 | 1425 |

Prediction For Wednesday NIFTY can go up if it goes above 21540 or down after the level of 21080 but all depends upon the Global cues.

Indian stocks started strong but faced a bearish onslaught, particularly in Mid and Smallcap segments. The index closed at 21,238.80, down 333 points, breaking the 21,200 support. Except for Pharma, all sectors, especially Media, Realty, and PSU Banks, corrected. Mid and small caps underperformed, losing 3.11% and 2.87%. The daily chart shows a large negative candle, but lower timeframes suggest a possible reversal. Targets are 21,540 and 21,600, with 21,080-21,000 as immediate support.

| Highest Call Writing at | 21540 (1.0 Crores) |

| Highest Put Writing at | 21080 (75.3 Lakhs) |

Nifty Support and Resistance

| Support | 21,080, 21,000 |

| Resistance | 21,540, 21,600 |

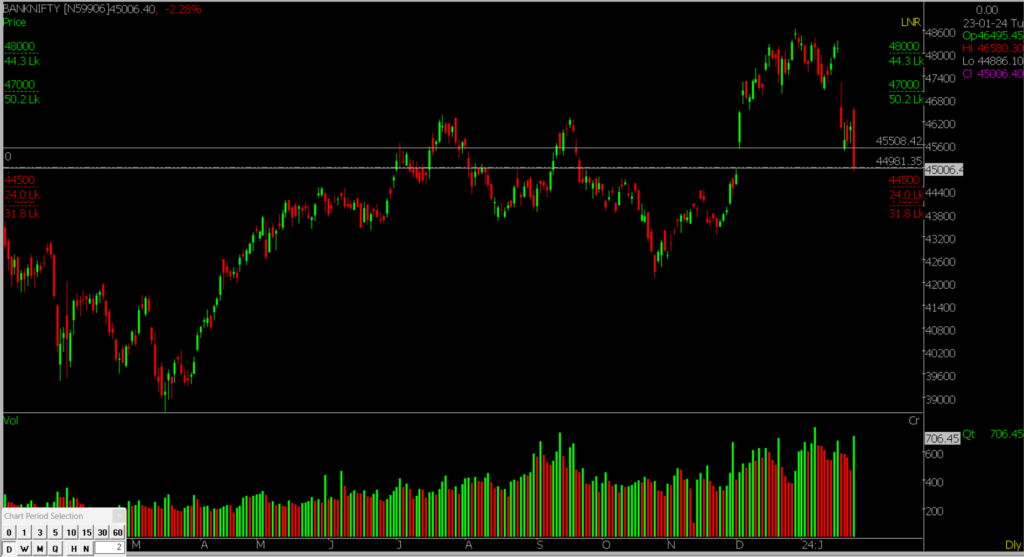

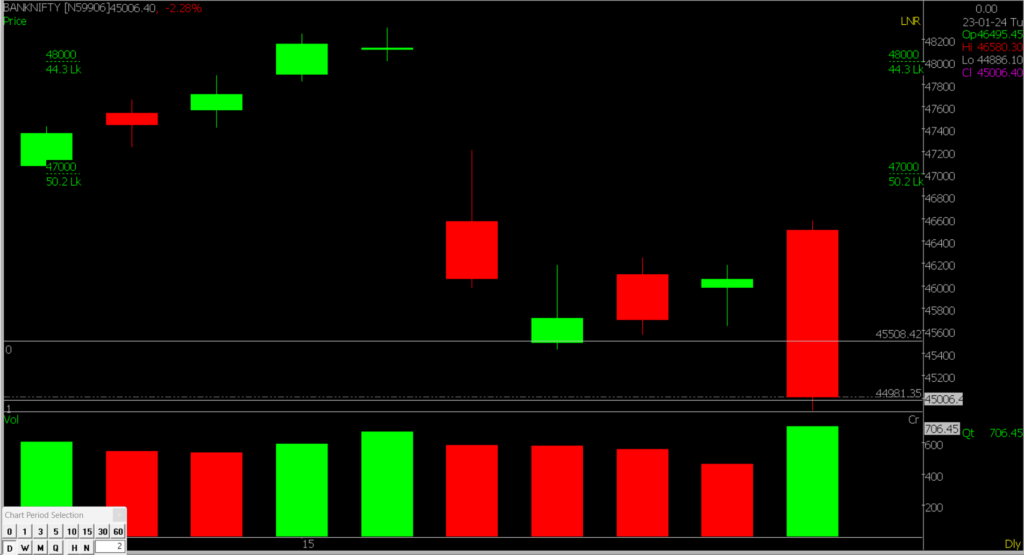

Bank Nifty Daily Chart Prediction.

Prediction For Wednesday Bank NIFTY can go up if it goes above 45500 or down after the level of 44980 but it all depends upon the Global cues.

Opening with a gap up, Bank Nifty faced selling pressure, continuing its downward trend. In the short term, the downside target for Bank Nifty is 44980, while the immediate hurdle on the upside is at 45,500.

| Highest Call Writing at | 45,500 (50.2 Lakhs) |

| Highest Put Writing at | 44,980 (24.0 Lakhs) |

Bank Nifty Support and Resistance

| Support | 44,980, 44,500 |

| Resistance | 45,500, 46,000 |

Also, check our Article on uses of Greek Analysis in Options Trading

If you’d like to know how we analyze the market and provide accurate levels every day. then click on the Free Demo button below and change your trading life for good. 5X returns are possible in options trading If you have Spider Software in your trading system.

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein.