In the Stock Market Today, Nifty climbs past 22,100, Sensex rises by +526 points; capital goods, real estate, and auto sectors show strong performance.

Stock Market Nifty Chart Prediction.

Indian stock indices ended positively, with Nifty gaining +0.54%, closing above 22,100; Sensex rose +526.01 points to 72,996.31.

Top Nifty gainers: Reliance Industries, Maruti Suzuki, Bajaj Auto, Bajaj Finance, Titan Company.

Top Nifty Losers: Hero MotoCorp, Tata Consumer Products, Apollo Hospitals, Dr Reddy’s Labs, Wipro.

Sectors like auto, banking, capital goods, power, realty, telecom rose by +0.5 to +1%;

metal, IT, media declined by -0.3 to -0.5%.

BSE Midcap index ended flat, Smallcap index rose +0.7%.

Stock Prediction for 28th March 2024.

| STOCK | Good Above | Weak Below |

| HAL | 3306 | 3277 |

| HAVELLS | 1502 | 1482 |

| SYNGENE | 715 | 708 |

| VEDL | 272 | 268 |

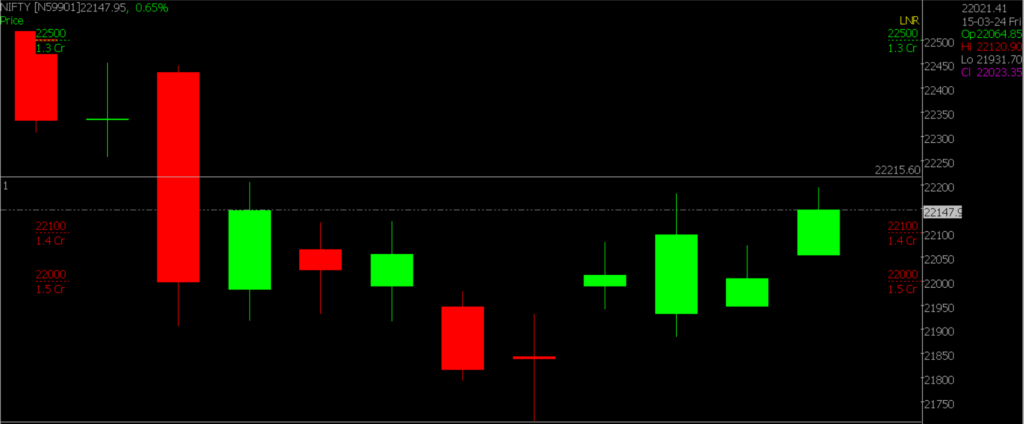

Prediction For Thursday, NIFTY can go up if it goes above 22,215 or down after the level of 22,100 but all depends upon the Global cues.

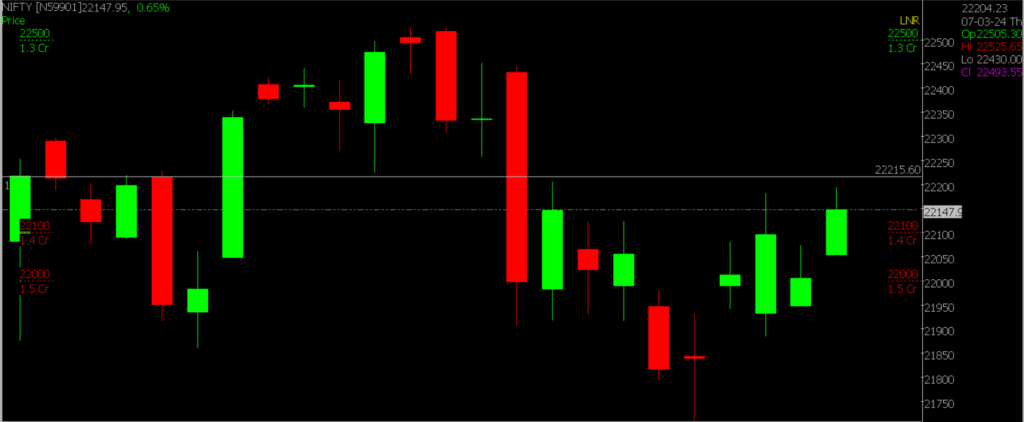

The Nifty started the day with a gap up and steadily rose, ending with a gain of +0.65%. Looking at the daily charts, it’s evident that the Nifty is approaching the 22215 – 22500 range, where various resistance levels are present. Both daily and hourly momentum indicators are showing conflicting signals, suggesting a potential period of consolidation. Therefore, if there’s a dip towards 22100 – 22000, it could be seen as an opportunity to buy with targets set at 22215 – 22500.

| Highest Call Writing at | 22,215 (1.3 Crores) |

| Highest Put Writing at | 22,100 (1.4 Crores) |

Nifty Support and Resistance

| Support | 22,100, 22,000 |

| Resistance | 22,215, 22,500 |

Bank Nifty Daily Chart Prediction.

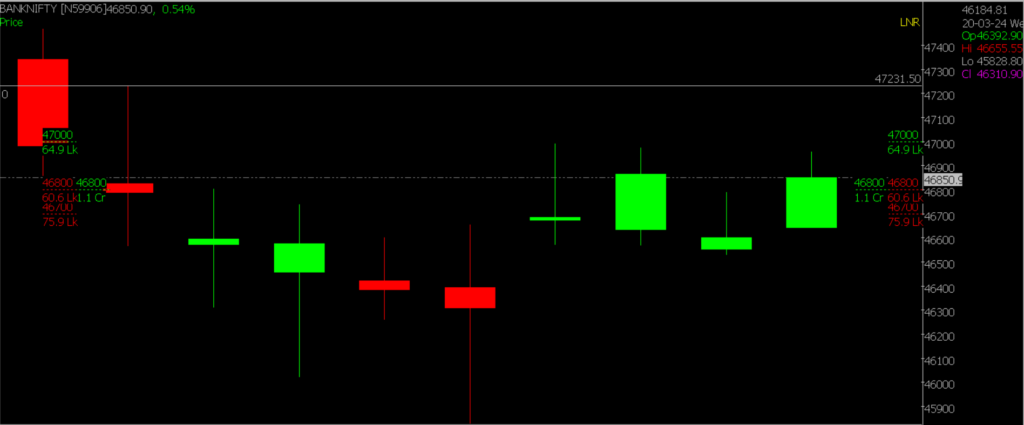

Prediction For Wednesday, Bank NIFTY can go up if it goes above 47,000 or down after the level of 46,800 but it all depends upon the Global cues.

For the past four trading sessions, the Bank Nifty has been consolidating between 46500 and 47000. A breakout from this range could result in significant directional movements. We anticipate an upside breakout, with short-term targets set at 47000 – 47230. On the downside, the support level is at 46800.

| Highest Call Writing at | 47,000 (64.9 Lakhs) |

| Highest Put Writing at | 46,800 (60.6 Lakhs) |

Bank Nifty Support and Resistance

| Support | 46,800, 46,700 |

| Resistance | 47,000, 47,230 |

Click here to learn the Difference Between Cryptocurrencies and Stocks.

Join our upcoming Webinar on How to use the payoff Calculator.

If you’d like to know how we analyze the market and provide accurate levels every day. then click on the Free Demo button below and change your trading life for good. 5X returns are possible in options trading If you have Spider Software in your trading system.

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein.