The demerger’s primary goal is to streamline the corporate structure and enhance shareholder value. Nonetheless, the most critical hurdle remains to repay the sizable debt, a challenge not evidently addressed by this strategic move.

The Previous Goal

A decade ago, mining billionaire Anil Agarwal of the Vedanta Group consolidated multiple entities into a single unit. Now, he is on the brink of dividing that unified unit into six distinct entities. The mining conglomerate merged these entities from 2012 to 2017 and briefly considered separate listed entities in November 2021 but dropped the idea.

The Current Goal

Announcing a six-way vertical split on Friday, they aim to “unlock significant shareholder value” for the listed entity. Vedanta shares had a good day in 2023, but they are still down over 25% for the year. The plan involves dividing the entities, emphasizing their core strengths. Shareholders will receive one share of the newly listed entity for each share they currently hold in Vedanta Ltd.

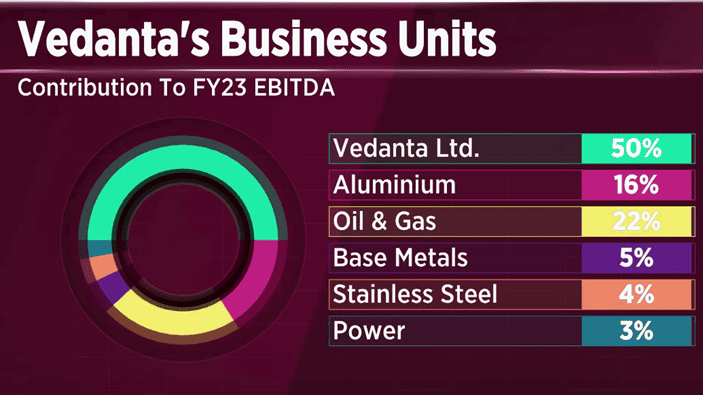

This is how the businesses after the demerger would appear:

Vedanta Ltd: The currently listed entity will retain its 64.92 percent stake in Hindustan Zinc, the upcoming semiconductor and display business, and the stainless steel business. In the financial year 2023, a significant portion of Vedanta’s operating profit was generated by Hindustan Zinc, followed by the oil and gas business.

Vedanta Aluminium: This entity will encompass the aluminum business and its 51 percent stake in BALCO.

Vedanta Oil & Gas: This division will focus on Cairn India.

Vedanta Base Metals: This segment includes the international copper and zinc businesses.

Vedanta Steel & Ferrous Metals: This entity will house the domestic iron ore business, Liberia assets, and ESL Steel Ltd.

Vedanta Power: All power assets will be part of this division.

The management emphasizes that the demerger will streamline its corporate structure, offering investors the choice to invest in their preferred commodity and enabling individual units to pursue their strategic objectives. Interestingly, these were the same reasons given a decade ago when the group merged the entities.

Pending approval from the board, stock exchanges, and the NCLT, this process is expected to span another 12-15 months.

How will the Demerger Benefit the Vedanta Group?

This move allows Vedanta Group to unlock value for investors, either by selling assets or partnering with strategic investors.

Under the current structure, there is double taxation on the profit from the sale of an asset and dividend payouts. However, after the demerger, the promoters will be subject to long-term capital gains tax only.

Debt reduction

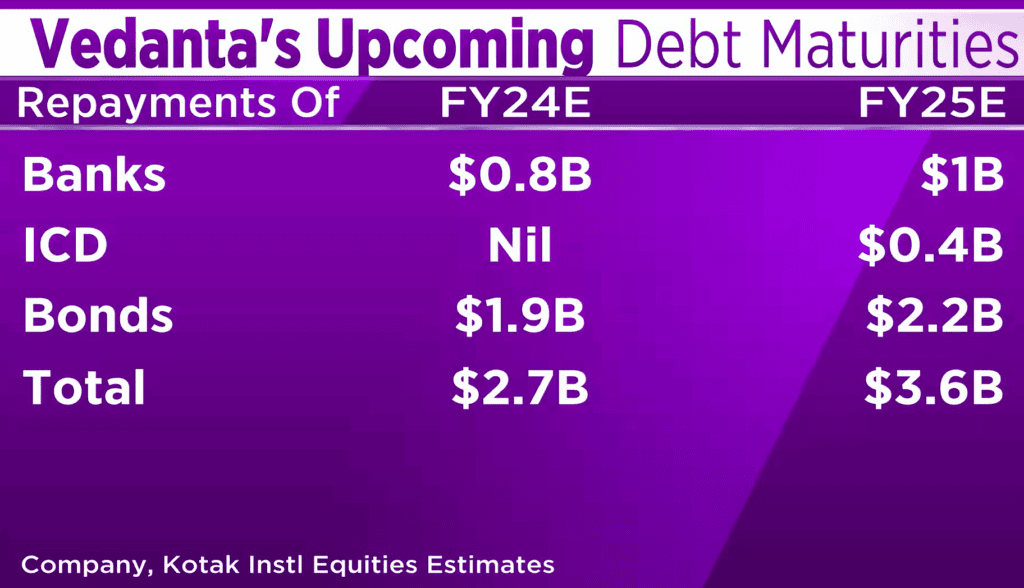

Though simplifying the corporate structure and unlocking value have benefits, the demerger doesn’t tackle the main issue: reducing debt.

Vedanta Resources faces impending payments of approximately $4 billion through the financial year 2025. The promoter entity has several cash-generating sources, including dividends from Hindustan Zinc and Vedanta Ltd., the potential sale of stakes in Vedanta Ltd., and brand fees from Vedanta Ltd. and its subsidiaries.

However, the current options are dwindling, particularly as Hindustan Zinc’s cash reserves have been depleted, as previously reported earlier this year. Additionally, credit rating downgrades have resulted in higher interest rates.

Vedanta Resources recently increased its stake by nearly 20 percent in the listed entity, but subsequently sold over 4 percent of it through block deals a couple of months ago, causing increased apprehension among investors.

Analysts on Vedanta

Investec maintained a sell recommendation on Vedanta as they highlighted the company has carbon-heavy assets and they also remain skeptical about the cash flow burn in the new ventures.

CLSA has upgraded the stock to outperform from its earlier rating of underperform. However, it has cut its price target to Rs 230 from Rs 250 as it believes the focus needs to shift to operational improvements for sustained re-rating.

Kotak Institutional Equities is concerned that the demerger might complicate cash flow management and increase earnings volatility, posing a risk for lenders. They believe the demerger contradicts Vedanta’s past efforts to consolidate holdings and that Vedanta Limited (VEDL) needs to divest non-core businesses due to the high leverage and funding gap at Vedanta Resources Limited (VRL), its parent company. According to them, the demerger alone is unlikely to create additional value, and they maintain a SELL recommendation with an unchanged target price of Rs 200, citing an unfavorable risk-reward scenario.

Nuvama has upgraded the stock to Hold as it believes the demerger is a step in the right direction. However, it has left its price target unchanged.

Motilal Oswal says the debt situation hasn’t improved, and both Vedanta and its holding company still face challenges in refinancing and repaying debt, especially with a significant portion maturing by CY25. The company’s handling of its debt will be a critical factor to watch in the future. We stick to our Neutral rating with a Rs 250 target based on our SoTP analysis.

To Summarize

Vedanta’s demerger simplifies structure and adds value but doesn’t address the critical debt issue. Financial institutions express concerns about cash flows and earnings volatility, with differing opinions on stock ratings. Vedanta’s debt remains a significant challenge, with its management under scrutiny. Overall, Vedanta’s future performance and stock value are uncertain due to its complex financial situation and corporate actions.

Attend the Traders Workshop on October 7, 2023, in DELHI in collaboration with Spider Software & Shree Lakshmi Shree. By Clicking Here!

Also, Check our Article on Strike Price in Options Trading.

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein.