The income tax rules for taxpayers in India will undergo significant changes as we enter the new financial year 2023-24.

These changes were announced by Union Finance Minister Nirmala Sitharaman during the annual Union Budget in February and will have a profound impact on taxpayers throughout the country. These changes include the introduction of a new tax regime, new provisions for TDS, increased deduction limits, faceless assessments, changes to the tax treatment of ULIPs, and more. Taxpayers will need to stay informed and adapt their strategies to comply with the new rules and minimize their tax burden.

Default tax regime:

When a taxpayer does not explicitly choose between the old and new tax regimes, they will be automatically enrolled in the new tax regime, which offers lower tax rates but without exemptions and deductions. Taxpayers must evaluate both regimes and choose the one that is more beneficial for them, considering their income and deductions. It’s important to note that taxpayers cannot switch between the two regimes during the financial year, so careful consideration is necessary when selecting a tax regime.

Tax rebate limit raised to ₹7 lakh:

Individuals with an annual income of up to ₹7 lakh can now avail tax exemptions without making any investments, thanks to the increase in the tax rebate limit from ₹5 lakh to ₹7 lakh. This change means that such individuals will have completely tax-free income, irrespective of the number of investments they make. The increase in the tax rebate limit is expected to benefit a significant number of taxpayers and help reduce their tax burden.

Standard deduction:

The standard deduction of ₹50,000, which was available to salaried individuals in the previous tax regime, will continue unchanged. Furthermore, the Finance Minister has announced that pensioners will now be eligible for the standard deduction benefit in the new tax regime. This means that pensioners can avail themselves of the standard deduction of ₹50,000 to lower their taxable income.

Leave Travel Allowance:

The government has increased the limit for tax-exempt Leave Travel Allowance (LTA) for non-government employees from the previous limit. The new limit for LTA exemption is now set at ₹25 lakh. This change will benefit non-government workers, as they can now claim tax exemption on LTA up to ₹25 lakh, thereby reducing their tax liability.

No LTCG tax benefit on these Mutual Funds:

From April 1, investments made in debt mutual funds will be subject to short-term capital gains tax, which means that investors will no longer be eligible for long-term financial benefits. This change implies that investors will no longer receive the LTCG (Long Term Capital Gains) tax benefit on their investments in debt mutual funds. As a result, investors will have to bear a higher tax liability, making these investments less attractive.

Market Linked Debentures (MLDs):

The classification of Market Linked Debentures (MLDs) as short-term financial assets from April 1 will end the grandfathering benefit for previous investments, slightly affecting the mutual fund sector. MLDs are debt instruments with returns linked to an underlying asset, and this change may shift investor preference towards other investment options. remove plagiarism

Life Insurance policies:

From April 1, 2023, any proceeds from life insurance policies with premiums exceeding Rs 5 lakh annually will be taxable. However, the Unit Linked Insurance Plan (ULIP) will not be subject to the new income tax regulation. ULIP is a type of insurance policy that combines life insurance and investment in a single plan. This change means that any returns earned from life insurance policies with premiums exceeding the threshold will be subject to income tax, but ULIP will continue to enjoy tax benefits.

Benefits to Senior Citizens:

The Indian government has recently announced a few benefits for senior citizens. The highest deposit limit for the Senior Citizen Savings Scheme (SCSS) has been increased from Rs 15 lakh to Rs 30 lakh, allowing senior citizens to deposit a larger amount and earn higher returns. The monthly income scheme (MIS) deposit limit has also been raised from Rs 4.5 lakh to Rs 9 lakh for single accounts and from Rs 7.5 lakh to Rs 15 lakh for joint accounts. These changes are expected to benefit senior citizens who rely on regular income from such savings schemes.

Physical gold conversion to e-gold receipt not to attract capital gains tax:

The Finance Minister, Nirmala Sitharaman, has announced that there will be no capital gains tax on converting physical gold to an Electronic Gold Receipt (EGR) or vice versa, effective from April 1, 2023. This means that investors can convert their physical gold to an EGR or vice versa without incurring any capital gains tax. This move is aimed at promoting investment in gold and gold-related financial instruments.

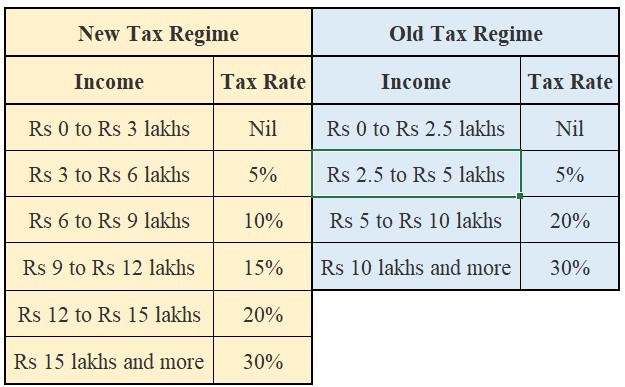

Changes in Income Tax slabs:

The income tax slabs for individuals have been revised from April 1, 2023, with zero tax for those earning up to Rs. 3 lakh. The new tax rates are as follows:

- For incomes between Rs. 3 lakh and Rs. 6 lakh, the tax rate will be 5%

- For incomes between Rs. 6 lakh and Rs. 9 lakh, the tax rate will be 10%

- For incomes between Rs. 9 lakh and Rs. 12 lakh, the tax rate will be 15%

- For incomes between Rs. 12 lakh and Rs. 15 lakh, the tax rate will be 20%

- For incomes above Rs. 15 lakh, the tax rate will be 30%

This change is expected to benefit low-income earners by exempting them from tax, while ensuring that those with higher incomes pay a higher tax rate.

Recent Comments on “New Income Tax Rule for Tax Payers : 10 New Rules You Must Know!”