The Boring Candle pattern is used for low volatility periods in the stock market for profitable trades, and advantages in trading.

What is Boring Candle Pattern?

The Boring Candle Pattern is a tool to know the market trends based on the candle body size relative to its range. A candle is Boring when it occupies the body as 50% or less of its total range.

The pattern helps to identify the orders that are pending or open positions by large players in the market. Additionally, Boring Candles can help identify potential Demand or Supply zones, providing insight into market sentiment and potential trading opportunities.

Boring Candles helps in giving valuable information for trading decisions and chances rate increases for the traders.

Main Factors To Consider When Analyzing Boring Candles.

When analyzing boring candles, there are several factors to consider. Small candle bodies and little to no shadows, indicating a lack of significant price movement are the way to identify a . Here are some essential things to look for when analyzing boring candles:

- Candle size: It’s crucial to observe the size of the real body and shadows. Boring candles have small bodies and equal-sized shadows, so look for candles that fit this description.

- Volume: Low volume during boring candles indicates a lack of interest from market participants.

- Timeframe: Although boring candles can appear on any timeframe. A boring candle on a higher timeframe may indicate a lack of interest in the asset over an extended period.

- Price Action: Boring candles often appear during periods of consolidation or a range-bound market. Thus, it’s necessary to examine the price action preceding and following the boring candle to understand if the market will continue to consolidate or if a breakout is imminent.

- Support and Resistance: If a boring candle appears near a significant support or resistance level, it’s worth observing. If the market has failed to break through these levels, it may indicate a lack of interest or conviction from market participants.

In conclusion, analyzing boring candles can provide valuable insight into market sentiment, but it’s essential to consider other technical and fundamental factors before making any trading decisions.

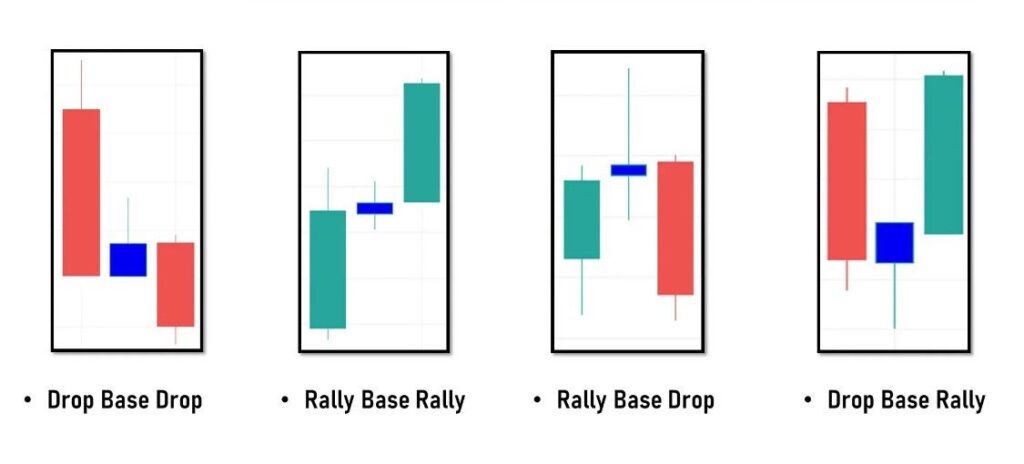

Types Of Boring Candle Patterns

1. Drop Base Drop

Drop Base Drop is a technical analysis pattern in the stock market that signals a potential bearish reversal. This pattern consists of two drops in the price i.e. starting candle will be red and also the last candle will be bearish with a brief pause in between, called the base.

As the price falls twice before finding a temporary support level, the sellers control the market in this pattern.

2. Rally Base Rally

Rally Base Rally is the reversal of the Drop Base Drop pattern. This pattern includes two rallies with a consolidation phase in between known as the base. It indicates that the buyers are gaining control of the market, with the price rising twice before finding a temporary resistance level.

3. Rally Base Drop

In Rally Base Drop the starting candle will be Green, the Boring candle will be between starting Candle and the last candle (It can be one or more boring candles) and the last candle will be Red which indicates a Falling trend.

4. Drop Base Rally

In Drop Base Rally starting candle will be Red, the Boring candle will be between starting Candle and the last candle (It can be one or more boring candles) and the last candle will be Green which indicates the Rising trend.

Where to find Boring Candle in Spider Software

Steps:

First Right Click – Then go to Chart Settings – then you’ll find “Boring” as the last option, in that set the parameters accordingly and Tick to enable.

*Note*: You can also find a boring candle of a particular body size.

If you want to find a boring candle of body size 45%, you can set the parameter as 45.

Key Takeaways

Small candle bodies and little to no shadows, indicating a lack of significant price movement are the characteristics for Boring Candles. They can appear on any timeframe and suggest a lack of interest or conviction from market participants. Here are some key takeaways on boring candles:

- They provide valuable insight into market sentiment during periods of consolidation or a range-bound market.

- Low volume during boring candles suggests a lack of direction or a waiting period for a catalyst.

- Boring candles can appear near key support and resistance levels, indicating a potential breakout or continuation of consolidation.

- Traders must consider other technical and fundamental factors before making any trading decisions based solely on boring candles.

In conclusion, boring candles may not seem significant on their own, but they can provide valuable insight when considered with other technical and fundamental factors. Traders can use them to understand market sentiment and make informed trading decisions.

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein.