In Stock market today Nifty ended below 19,550, Sensex down 308 pts; FMCG, banks major hit

Stock Market Nifty Chart Prediction.

The Nifty commenced trading with a neutral stance and underwent another day of remarkable volatility. It concluded the session with a negative movement, declining by around 80 points. Upon examining the daily charts, it’s evident that the Nifty encountered resistance at a descending trend line, and the 20-day moving average is positioned within the range of 19630 to 19670. Despite attempts, the Nifty couldn’t sustain follow-through buying and operated within the confines of the 19645 to 19467 range seen in the preceding trading session. As long as the Nifty remains below the zone of 19630 to 19670, it’s anticipated that the prevailing pressure will persist. The divergence in signals from momentum indicators on both daily and hourly time frames might pave the way for a short-term consolidation. On the whole, the trend remains unfavorable, with a projected short-term target of 19100.

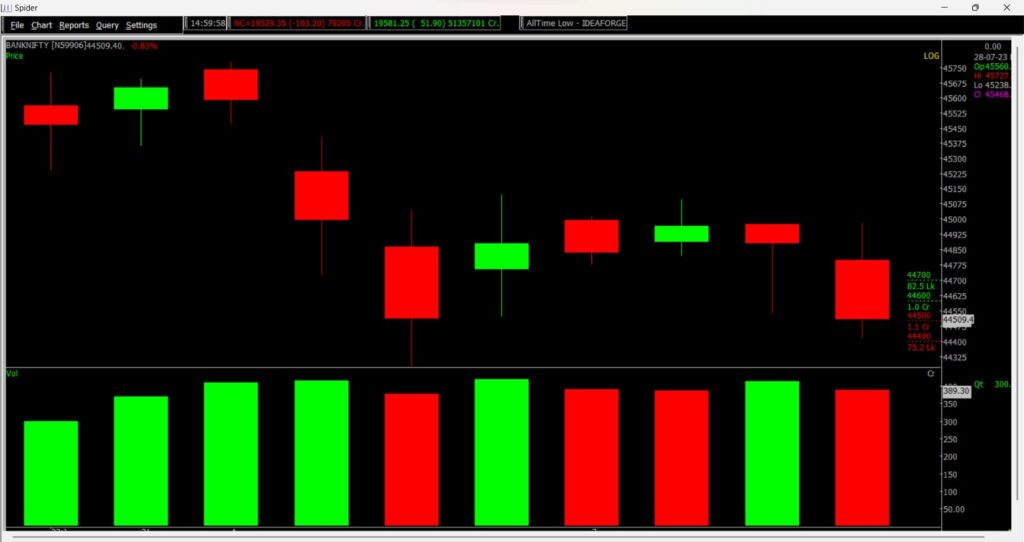

Turning to the Bank Nifty, it encountered selling pressure around the significant hourly moving averages situated in the bracket of 45000 to 45100. The daily and hourly momentum indicators exhibited a negative crossover, signaling a selling trend. Notably, the Bank Nifty concluded below the 40-day moving average, indicating inherent weakness. Consequently, both price and momentum indicators collectively suggest further downward movement in the upcoming trading sessions. The immediate short-term target stands at 44000 on the downside.

Prediction For Friday NIFTY can go up if it goes above 19600 or go down after the level of 19500 but all depend upon the Global cues.

Today nifty opened in yesterday’s range after that it goes in the upward direction just after RBI policy started but the upward trend does not continue after RBI increase in CRR for banks. For Friday market can go in any of direction as there is US CPI data which is move the market. So just follow the level above.

| Highest Call Writing at | 19550 (1.9 CR) 19600 (2.4 CR) |

| Highest Put Writing at | 19500 ( 2.5 CR) 19450 (1.2 CR) |

Nifty Support and Resistance

| Support | 19500,19450 |

| Resistance | 19600,19650 |

Bank Nifty Daily Chart Prediction

Prediction For Friday Bank NIFTY can go up if it goes above 44750 or go down after the level of 44400 but all depend upon the Global cues.

Today, BANK NIFTY was weak as compared to nifty after the RBI policy. But today also bank nifty has again closed in red above its critical level of 44500 which has made bank nifty weak again For Friday you can go with the strategy of buy nifty sell bank nifty. But there is US CPI data which will decide the next move of bank nifty.

| Highest Call Writing at | 44600 (1 CR) 44700 (82 LK) |

| Highest Put Writing at | 44500 ( 1.1 CR) 44400 ( 76 LK ) |

Bank Nifty Support and Resistance

| Support | 44400,44275 |

| Resistance | 44600,44750 |

Top 07 Stocks near 52 week low

| Stocks | CMP |

| Vedanta Ltd | 243.90 |

| SRF Ltd | 2,293 |

| UPL | 610 |

| V I P Industries Ltd | 697 |

| GMM Pfaudler Ltd. | 1,448 |

| JK Paper Ltd. | 330.50 |

| IPCA Laboratories Ltd | 903 |

If you’d like to know how do we analyze the market and provide accurate levels every day. then click on the Free Demo button below and change your trading life for good. 5X returns is possible in options trading, If you have Spider Software in your trading system.

Also, Check out our article on Why should you trade in BSE Options?

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein.