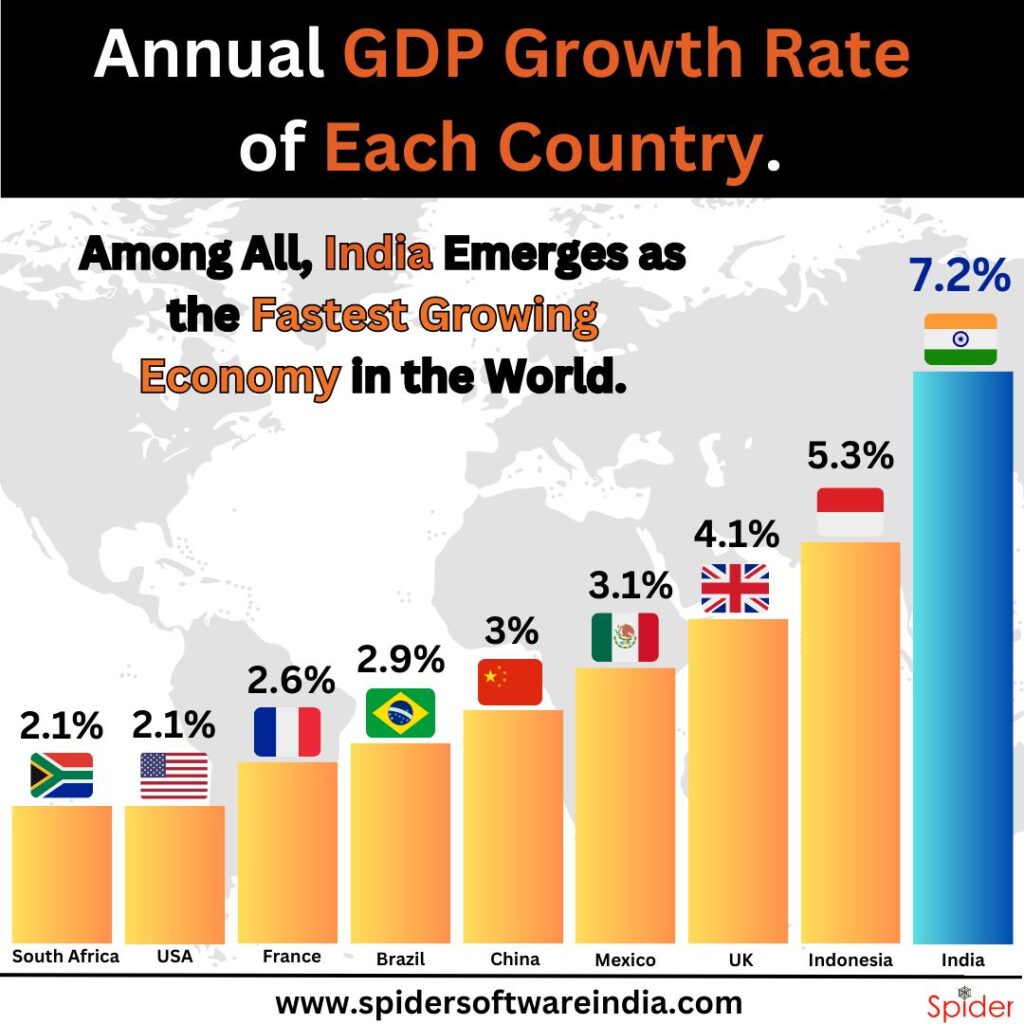

India’s economy grew 6.1% in Q4 FY23, up from 4.4% in Q3, indicating a significant improvement in growth. India’s economy recorded an impressive 7.2% growth for FY22-23, benefiting from the positive trend observed throughout the year. These figures have surpassed expectations and indicate a robust economic expansion for the country during this period.

What is GDP ?

Gross Domestic Product (GDP) is a widely utilized metric that measures the economic activity of a country. Gross Domestic Product (GDP) measures the total value of goods and services produced within a country in a specified time. GDP serves as a means to evaluate the size and growth of an economy.

To calculate GDP, there are various methodologies available, with the expenditure method being the most common. This method sums up the total spending on consumption, investment, government expenditure, and net exports (exports minus imports). The income method combines individual and business incomes, including wages, profits, rents, and interest, as an alternative approach.

What does latest GDP growth indicate for Indian stock markets?

Currently, both the Sensex and Nifty 50 indices in India are approaching their all-time high levels. On Wednesday, the Sensex experienced a decline of 346.89 points or 0.55% to settle at 62,622.24. Similarly, the Nifty 50 witnessed a dip of 99.45 points or 0.53%, closing at 18,534.40.

In May, both the Sensex and Nifty 50 indices showed positive performance, with each index rising over 2%.

The Nifty index has recently surpassed the range of 16,000-18,000 levels, indicating a breakout. This development suggests that the market is poised to reach new highs in the second half of 2023. The broader markets have rebounded strongly after a corrective phase of 18-20 months since their peak in October 2021.

We are optimistic about equity markets, expecting a multi-year upcycle in the Indian economy to begin. Our confidence is based on assessing current conditions and foreseeing sustained economic growth in the upcoming years.

Central government finances outlook for FY24

The Indian government successfully achieved the fiscal deficit target of 6.4% of GDP in FY23. This accomplishment was supported by strong gross tax collections and a focus on capital expenditure (capex), which emerged as the major highlights of the government’s fiscal performance throughout the year.

It is anticipated that the growth in gross tax revenue may experience some moderation due to a lower nominal GDP growth rate. However, there is a positive development on the non-tax revenue front, as the Reserve Bank of India (RBI) has transferred ₹87,416 crore compared to ₹30,307 crores in the previous fiscal year. Moreover, the dividend payout from the RBI alone has exceeded the budgeted amount of ₹48,000 crore, considering contributions from RBI, nationalized banks, and financial institutions collectively. This is expected to provide support to the government’s finances in the current fiscal year, particularly in light of slower disinvestment receipts

What were the surprise elements in GDP Q4 FY23 growth?

The fourth-quarter GDP numbers for India have come as a pleasant surprise, showing a growth rate of 6.1%. This indicates a robust revival in the Indian economy, which goes against expectations and macro challenges. The momentum has significantly accelerated, and there is a broad-based recovery observed across various sectors, including manufacturing, mining, construction, and agriculture.

The farm and agriculture sectors have emerged as the surprise elements in the economic revival, while manufacturing growth has been relatively stable and in line with expectations. Overall, there has been a revival in economic activity driven by strong government investments. However, the consumption side of the economy is yet to catch up, which remains a concern.

The current economic recovery is largely driven by capital expenditure (capex), and this focus on investment-led growth has helped keep the Indian economy afloat compared to other major global economies. As a result, there are expectations of positive market performance and potential revisions from the Reserve Bank of India (RBI) in its upcoming policy meetings to further support the economy.

Also, Check out our article on TRADING PSYCHOLOGY – The most important aspect of Trading?

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein.