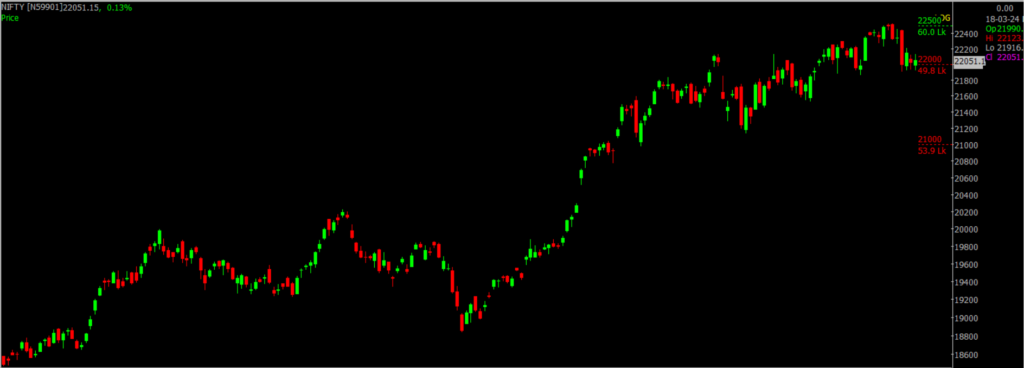

In the Stock Market Today, Sensex rises by 105 points, Nifty reaches 22,050, driven by auto and metals sectors.

Stock Market Nifty Chart Prediction.

Indian benchmark indices recovered losses from the previous session, ending lower, with Nifty around 22,000.

At close, the Sensex gained 104.99 points (0.14%), reaching 72,748.42, while the Nifty climbed 32.40 points (0.15%), closing at 22,055.70.

Top Losers included Tata Consumer Products, UPL, Infosys, Adani Ports and Titan Company.

while Gainers were Tata Steel, M&M, JSW Steel, Tata Motors and Apollo Hospitals.

Sectors capital goods, healthcare, auto, realty, metal, and media witnessed gains ranging from 0.5% to 3% whereas IT and FMCG sectors experienced declines ranging from 0.5%

BSE Midcap and Smallcap indices ended on a flat note.

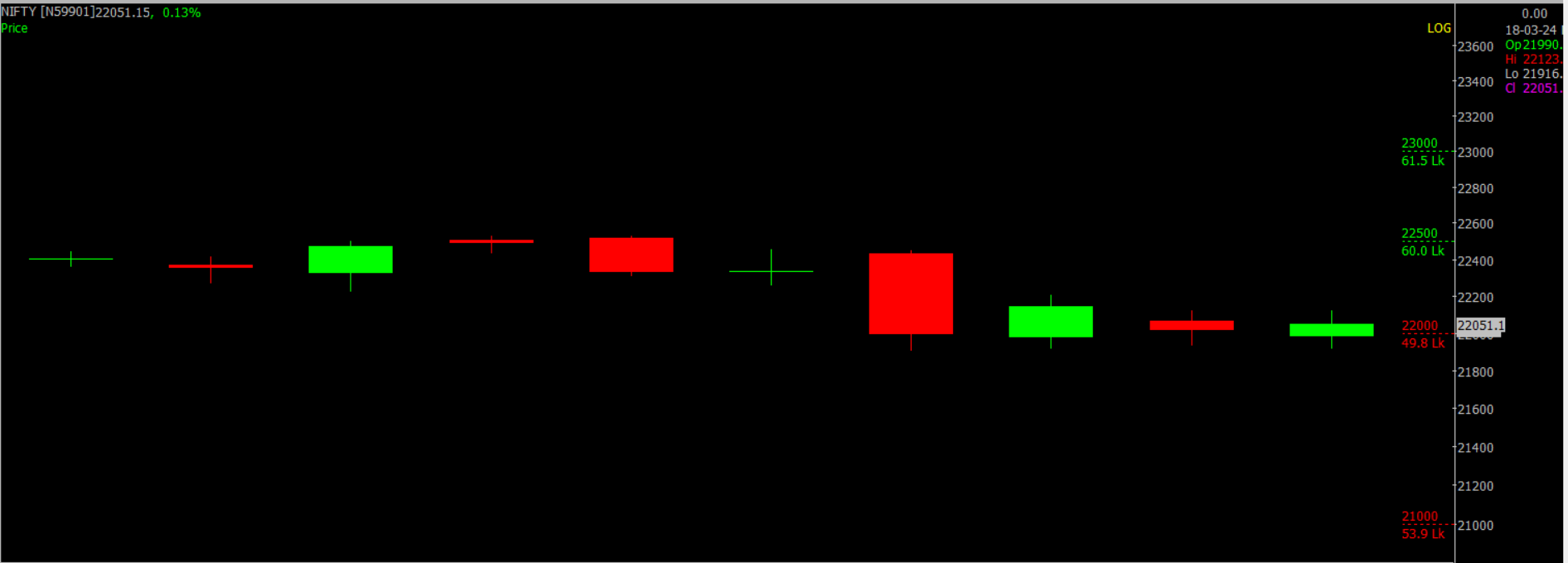

Stock Prediction for 19th March 2024.

| STOCK | Good Above | Weak Below |

| CIPLA | 1502 | 1482 |

| HDFCBANK | 1463 | 1440 |

| HINDALCO | 535 | 529 |

| HAVELLS | 1502 | 1482 |

Prediction For Tuesday, NIFTY can go up if it goes above 22,500 or down after the level of 22,000 but all depends upon the Global cues.

Despite a weak opening, the Nifty rebounded, closing with a 32-point gain. It maintained support around 22,000 and 21,500, trading within the range of 21,900 to 22,200 for the last three sessions. Until the support holds, positive momentum is expected, with immediate resistance at 22,500 to 23,000 and crucial support at 22,000 to 21,500.

| Highest Call Writing at | 22,500 (60.0 Lakhs) |

| Highest Put Writing at | 22,000 (49.8 Lakhs) |

Nifty Support and Resistance

| Support | 22,000, 21,500 |

| Resistance | 22,500, 23,000 |

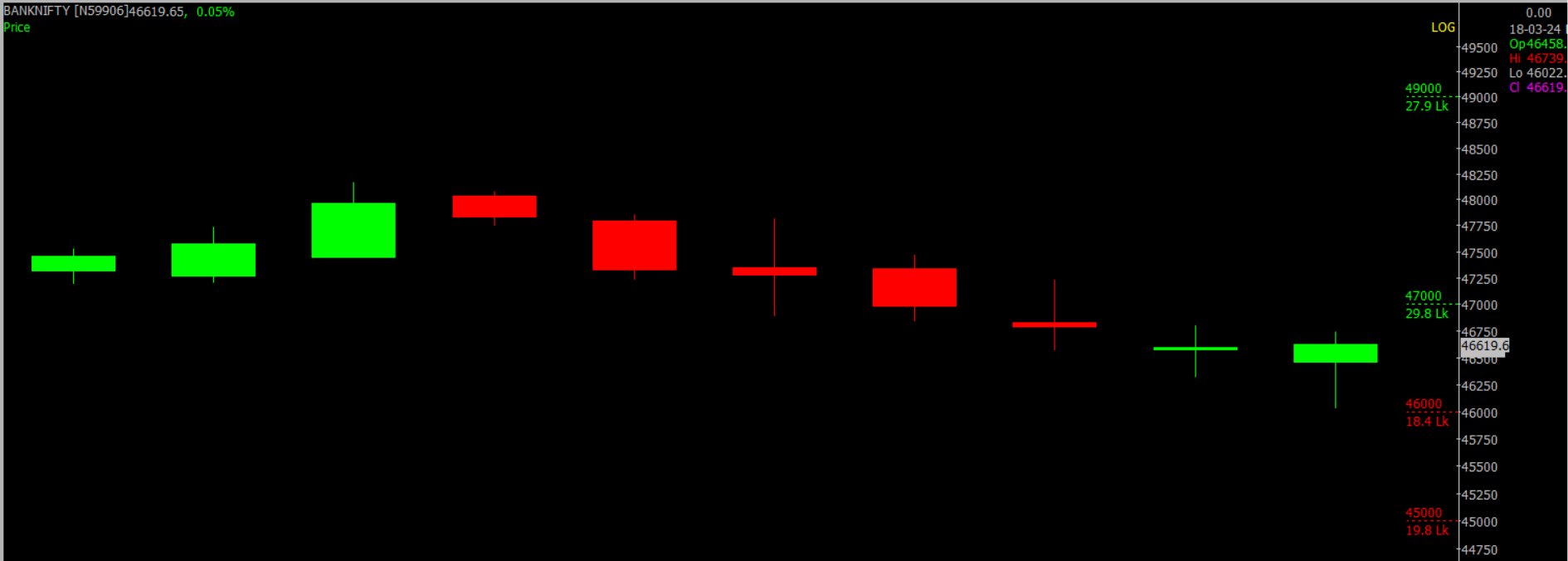

Bank Nifty Daily Chart Prediction.

Prediction For Tuesday, Bank NIFTY can go up if it goes above 47,000 or down after the level of 46,000 but it all depends upon the Global cues.

The Bank Nifty ended the day in the red for the seventh consecutive trading session. Despite this, it showed a significant rebound from its intraday lows of 46,022. We foresee a potential recovery and upward movement for the Bank Nifty in the near future. Resistance levels are expected to lie within the range of 47,000 to 48,000, while support is identified between 46,000 & 45,000 on the downside.

| Highest Call Writing at | 47,000 (29.8 Lakhs) |

| Highest Put Writing at | 46,000 (18.4 Lakhs) |

Bank Nifty Support and Resistance

| Support | 46,000, 45,000 |

| Resistance | 47,000, 48,000 |

Click here to learn about the Top 5 Powerful Candlestick Patterns to know in Stock Market 2024

Join our upcoming FREE WEBINAR on Identifying reversal points with the help of OI & PCR data.

If you’d like to know how we analyze the market and provide accurate levels every day. then click on the Free Demo button below and change your trading life for good. 5X returns are possible in options trading If you have Spider Software in your trading system.

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein.