In the Stock Market Today, Nifty hits 22,150 and the Sensex is up by 600 points, with banks and metals performing well.

Stock Market Nifty Chart Prediction.

On April 19, Sensex rose by 599.34 points, a closing at 73,088.33, while the Nifty increased by 151.20 points or ending at 22,147. The market saw 1,576 shares advancing, -1,770 declining, and 95 remaining unchanged.

Top Nifty gainers: Bajaj Finance, M&M, HDFC Bank, Maruti Suzuki and JSW Steel

Top Nifty Losers: Bajaj Auto, HCL Technologies, Divis Labs, TCS and Nestle India.

Sector-wise, Bank and Metal indices rose by 1% each, FMCG by 0.5%, while healthcare, IT, power, and realty sectors fell between 0.3% and 0.6%.

BSE midcap index fell by 0.4% and smallcap index ended flat.

Stock Prediction for 22nd April 2024.

| STOCK | Good Above | Weak Below |

| CROMPTON | 298 | 294 |

| DEEPAKNTR | 2280 | 2256 |

| MARICO | 506 | 501 |

| TCS | 3844 | 3813 |

Prediction For Monday, NIFTY can go up if it goes above 22,500 or down after the level of 22,000 but all depends upon the Global cues.

Markets experienced another day of volatility but ultimately closed up by more than half a percent. Starting the day lower due to weak global signals, the markets showed little movement initially. However, a steady improvement in major stocks across various sectors helped to offset early losses and moved the indices into positive territory. Resistance is noted between 22,500 and 22,800, while support is expected between 22,000 and 21,800.

| Highest Call Writing at | 22,500 (70.2 Lakhs) |

| Highest Put Writing at | 22,000 (81.8 Lakhs) |

Nifty Support and Resistance

| Support | 22,000, 21,800 |

| Resistance | 22,500, 22,800 |

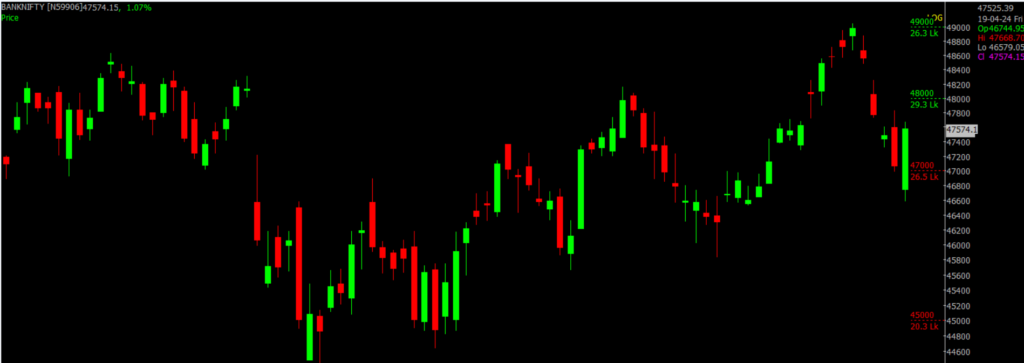

Bank Nifty Daily Chart Prediction.

Prediction For Monday, Bank NIFTY can go up if it goes above 48,000 or down after the level of 47,000 but it all depends upon the Global cues.

Bank Nifty Index continues to be dominated by bearish trends, as any attempts at gains are met with strong selling, indicating a ‘sell on rise’ approach among traders. Significant resistance is noted between 48,000 and 48,300, where heavy call writing has been recorded. With a generally bearish market sentiment, continued selling pressure could push the index down to its next key support levels between 47,000 and 46,500.

| Highest Call Writing at | 48,000 (29.3 Lakhs) |

| Highest Put Writing at | 47,000 (26.5 Lakhs) |

Bank Nifty Support and Resistance

| Support | 47,000, 46,500 |

| Resistance | 48,000, 48,300 |

Click here to learn the Stocks to Watch as Tensions Between Israel and Iran Escalates.

Join our upcoming free Webinar on Understanding Price Action Techniques: A Guide to Effective Trading

If you’d like to know how we analyze the market and provide accurate levels every day. then click on the Free Demo button below and change your trading life for good. 5X returns are possible in options trading If you have Spider Software in your trading system.

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein.