In Stock Market Today, the Sensex climbs 320 points, with Nifty surging above 19,600. Notably, both metal and pharma sectors see a 2% gain.

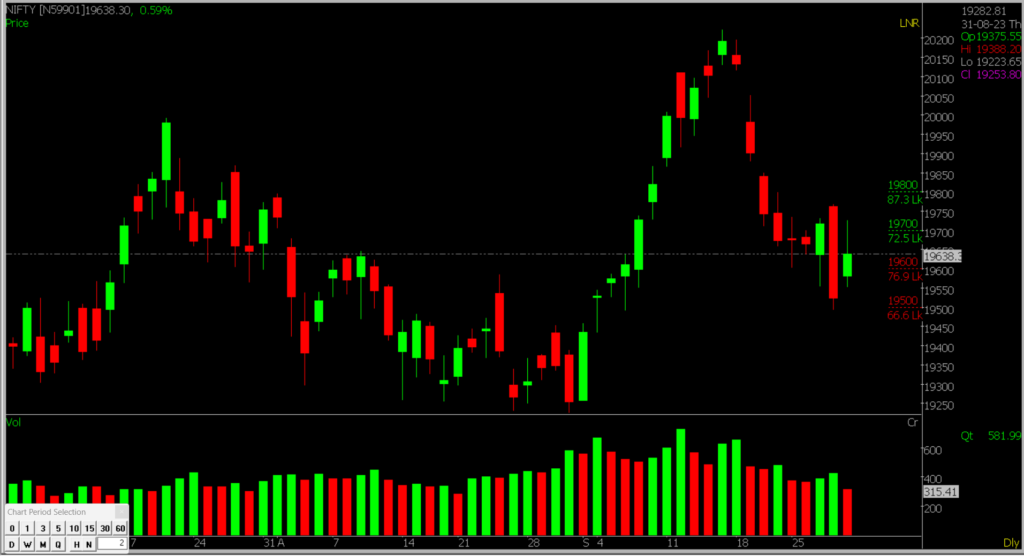

Stock Market Nifty Chart Prediction.

Leading the Nifty’s gainers were Hindalco Industries, NTPC, Hero MotoCorp, Dr. Reddy’s Laboratories, and Divis Lab. On the flip side, Adani Enterprises, LTI Mindtree, HCL Technologies, Tech Mahindra, and Power Grid saw losses.

With the exception of Information Technology, all sectoral indices closed positively. The metal, power, oil & gas, PSU Bank, and healthcare indices rose by 1-2.7 percent.

The BSE Midcap index climbed 1.3 percent, and the BSE Smallcap index increased by 0.6 percent.

Stock Market Prediction For Tuesday NIFTY can go up if it goes above 19700 or go down after the level of 19650 but it all depends upon the Global cues.

The markets attempted to recover after a fall on Thursday and ended the day with a modest 0.59% gain, closing at 19,638.30. While most of the trading session was positive, a dip in the final hour reduced the overall gains. The pharmaceutical and metal sectors performed well, but the IT sector remained subdued. Overall, there was positive activity in the broader market.

Although the rate of decline has slowed down, the overall sentiment is still negative. It’s unlikely to change until the Nifty index firmly crosses the 19,700 mark.

| Highest Call Writing at | 19,800 (87.3 Lakhs) |

| Highest Put Writing at | 19,650 (76.9 Lakhs) |

Nifty Support and Resistance

| Support | 19650 & 19,500 |

| Resistance | 19,700 & 19,800 |

Bank Nifty Daily Chart Prediction

Prediction For Tuesday Bank NIFTY can go up if it goes above 45000 or go down after the level of 44250 but it all depends upon the Global cues.

The Bank Nifty saw a rebound and ended up near the 20-week moving average, which is at 44,584 points. This is considered a positive development. The Bank Nifty’s downward momentum is slowing down, and this is supported by a positive difference in the hourly time frame. In the short term, the prediction would be a bounce back in the range of 45,000 to 45,250 points on the upside.

| Highest Call Writing at | 45000 (26.3 Lakhs) |

| Highest Put Writing at | 44250 (27.0 Lakhs) |

Bank Nifty Support and Resistance

| Support | 44250 & 43000 |

| Resistance | 45000 & 46000 |

Learn about the Price Actions & take your Trading Skills to New Heights. By Clicking Here!

If you’d like to know how we analyze the market and provide accurate levels every day. then click on the Free Demo button below and change your trading life for good. 5X returns are possible in options trading If you have Spider Software in your trading system.

Also, Check out our article on Top of Cryptocurrencies to look for in 2023.

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein.