In Stock Market Today, the Sensex dropped by 221.09 points, or 0.33 percent, to 66,009.15, while the Nifty fell by 68.00 points, or 0.34 percent, to 19,674.30. Among the stocks, 1747 went up, 1779 went down, and 143 remained the same.

Stock Market Nifty Chart Prediction.

The benchmark indices on 22nd September 2023 opened with little change, reflecting a subdued trend in Asia. The day witnessed volatility, with PSU banks and automobiles holding early gains, while IT, metals, and pharma sectors struggled.

In the Sensex companies, State Bank of India, Bajaj Finserv, IndusInd Bank, Maruti, and Mahindra & Mahindra saw significant gains.

On the other hand, Wipro, Power Grid, Titan, and Tata Steel performed less favorably.

Public sector banks experienced significant buying activity following JP Morgan’s announcement of India bond inclusion, while the pharmaceutical and metals sectors were the major losers. Market breadth also leaned towards declines, with approximately 1,747 shares rising, 1,779 falling, and 143 remaining unchanged.

For the week, the market saw its largest weekly decline in seven months, ending a three-week winning streak, with the Sensex and Nifty both falling by around 3 percent. The Nifty Bank index dropped by more than 3 percent, while the Nifty Midcap 100 lost around 2 percent for the week. All sectoral indices, except the PSU Bank index, reported weekly losses.

Power Grid, Asian Paints, Coal India, NTPC, and HDFC Life were the top gainers in the Nifty, while HDFC Bank, UltraTech, Dr. Reddy’s Laboratories, and Wipro were the biggest laggards.

Among midcaps, Berger Paints, REC, PFC, Union Bank, and Canara were the leaders in terms of gains. Conversely, GNFC, Syngene, Zydus, and Godrej Properties were among the hardest-hit midcap stocks.

Prediction For Monday NIFTY can go up if it goes above 19800 or go down after the level of 19600 but it all depends upon the Global cues.

In Today’s Market Nifty faced continuous selling pressure followed out during the week, leading to a 2.80% drop from its highest point. This correction has pushed it below the important 21-day Exponential Moving Average (21EMA). Currently, the sentiment seems pessimistic, and a crucial support level is seen at 19,600. If it falls below this level, it could trigger a more substantial market correction. On the positive side, 19,800 is anticipated to act as a resistance level.

| Highest Call Writing at | 19,800 (1.1 crores) |

| Highest Put Writing at | 19,500 (1.4 crores) |

Nifty Support and Resistance

| Support | 19500 & 19,400 |

| Resistance | 19,800 & 19,900 |

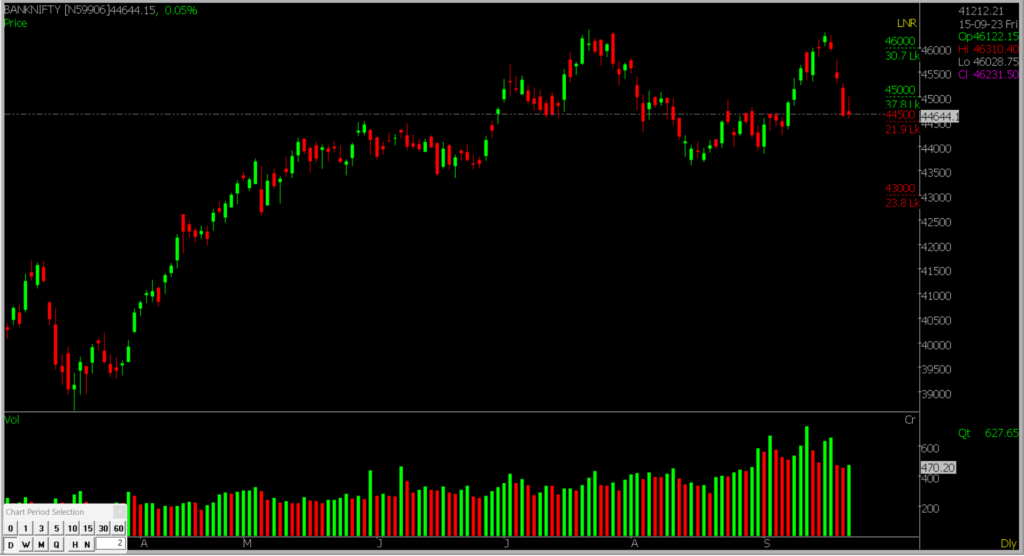

Bank Nifty Daily Chart Prediction

Prediction For Monday Bank NIFTY can go up if it goes above 45000 or go down after the level of 44200 but it all depends upon the Global cues.

The BANKNIFTY index, which currently stands at 44,644 points, showed a significant double-top breakdown pattern, which often indicates a trend reversal. This bearish pattern was mainly due to selling pressure in HDFC Bank. The index dropped below its 20-day moving average (20DMA) at 45,000. If it goes above this level, it might lead to some short-covering, but the overall sentiment remains bearish. The nearest support is around 44200 to 44000.

| Highest Call Writing at | 45000 (37.8 Lakhs) |

| Highest Put Writing at | 44200 (21.9 Lakhs) |

Bank Nifty Support and Resistance

| Support | 44200 & 44000 |

| Resistance | 44800 & 45000 |

An Opportunity to Learn Live Trading and Training on Monthly Expiry by Clicking Here

If you’d like to know how we analyze the market and provide accurate levels every day. then click on the Free Demo button below and change your trading life for good. 5X returns are possible in options trading If you have Spider Software in your trading system.

Also, Check out our article on the Inclusion of Government Indian Bonds in the JP Morgans Emerging Market Index.

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein.