The Wholesale Price Index (WPI) inflation has been on a downward trend recently, reaching 1.34 percent in March. This marks a significant decline from the 3.85 percent recorded in February and the 4.73 percent in January.

What is WPI Inflation?

The Wholesale Price Index (WPI) is a metric that reflects the prices of goods at the wholesale level, primarily involving bulk sales and trade between organizations rather than individual consumers. Certain economies commonly use it as an indicator of inflation.

Importance of WPI Inflation in India.

In India, the Wholesale Price Index (WPI) holds significant importance as a measure of inflation. It has a considerable influence on fiscal and monetary policy adjustments. The United States employs the Producer Price Index (PPI) to gauge inflation.

The WPI provides a straightforward and convenient approach to calculating inflation. Comparing the WPI at the start and end of a year allows determination of the inflation rate. The percentage rise in WPI over the course of a year indicates the inflation rate for that particular period.

What is the current situation of WPI Inflation in India?

Predictions indicate that India’s Wholesale Price Index (WPI) inflation likely dropped below zero in April, primarily influenced by the base effect. This would be the first time it has done so since July 2020.

The WPI inflation has been declining over the past few months, reaching 1.34 percent in March. In February, it stood at 3.85 percent, while in January, it was 4.73 percent.

The WPI inflation remained stable with a slight increase in primary article inflation (1.16 percent), offset by a decrease in fuel & power (-1.26 percent) and manufactured products (-0.28 percent).

The decrease in WPI is likely to positively impact retail prices, leading to a cooling effect. In April, India’s Consumer Price Index (CPI)-based inflation significantly softened to 4.70 percent, the lowest in 18 months.

Experts attribute the drop in WPI inflation to the base effect and lower commodity prices.

They indicate that China’s PPI has an influence on India’s WPI, and a deeper decline in China’s PPI can impact India’s WPI. While experts anticipate significant decreases in both WPI and CPI, they suggest that the services sector may undergo higher inflation, resulting in elevated CPI inflation.Predictions state that food and core WPI will turn negative in April, while fuel inflation will remain in single digits. Looking ahead, experts project that WPI inflation will stay low (negative or in low single digits) for the next 6-12 months, assuming stable domestic food prices and global commodity prices.

What factors influenced the WPI inflation in March 2023?

WPI inflation in March 2023 experienced a significant decrease primarily driven by lower inflation rates in manufactured products and fuel. Manufacturing inflation dropped from 3.06% in January 2023 to 1.94% in February 2023 and further declined to -0.77% in March 2023. As manufacturing holds a substantial weightage of 64.2% in the overall WPI basket, it had a notable impact on pulling down WPI inflation. Energy inflation also decreased due to a global correction in commodity prices, reaching 8.96%, one of the lowest figures in the past year. Food inflation was lower as well, potentially influenced by weaker Kharif crop output and its impact on specific food items.

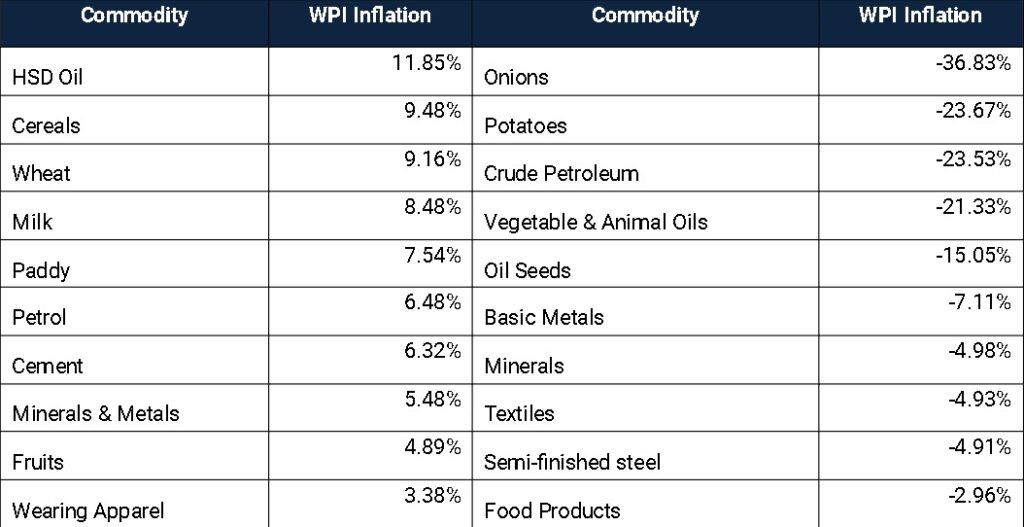

Specific products that experienced higher inflation in March 2023 included High-Speed Diesel (HSD) at 11.85%, cereals at 9.48%, wheat at 9.16%, milk at 8.48%, paddy at 7.54%, and petrol at 6.48%. On the other hand, certain items contributed to negative triggers for WPI inflation in March 2023, such as onions at -36.83%, potatoes at -23.67%, crude petroleum at -23.53%, vegetable oils at -21.33%, oil seeds at -15.05%. These factors collectively influenced and kept WPI inflation in check during the given period.

How would the RBI view the falling WPI inflation?

Falling WPI inflation has a mixed impact on the RBI. It serves as an important indicator for CPI inflation, and the RBI is optimistic about its potential to decrease CPI inflation. However, the RBI remains cautious and awaits clearer signals before making decisions on interest rates. Balancing inflation control and growth concerns, the RBI considers the Indian economic context and is not overly concerned with monetary divergence from the US Federal Reserve. While falling WPI inflation is encouraging, the RBI faces challenges such as persistent consumer inflation, uncertain growth, and the impact of rising rates on corporate profitability. The April 2023 policy marked a relatively less aggressive stance, with falling WPI inflation playing a part but not being the sole determinant in decision-making.

Highlighting changes in the overall inflation trends:

- In April, the inflation rate for manufactured products in the Wholesale Price Index (WPI) stood at -2.42%, showing a more significant decrease compared to the previous month’s rate of -0.77%.

- the food inflation rate in April was 0.17%, indicating a substantial drop from the 2.32% recorded in March.

- edible oils inflation experienced a notable decline, reaching -25.91% in April, compared to -21.33% in March.

- the inflation rate in February remained unchanged at 3.85%.

These figures demonstrate the fluctuations in price levels for various categories of goods, highlighting changes in the overall inflation trends.

Conclusion:

India’s WPI inflation has fluctuated across sectors, including manufactured products, food, and edible oils, with downward pressure on prices. These fluctuations in WPI inflation have implications for the overall economy, consumer affordability, and policy decisions. Monitoring and managing WPI inflation is crucial to ensure India’s price stability and sustainable economic growth.

Also, check out our Blog on The Symmetrical Triangle Chart Pattern

Want to Learn How to do Trading in Live Market? With systematic Trading Strategy on the Day of Expiry. *Click Here To Know*

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein.