A mutual fund is a type of investment vehicle that allows multiple investors to pool their money and buy a diversified portfolio of securities, such as stocks, bonds, or other assets.

What is a Mutual Fund?

A professional investment manager manages the fund and makes investment decisions based on its investment objectives. The underlying portfolio generates capital gains, dividends, and interest income, which allow investors in the mutual fund to earn returns. By purchasing shares in the fund, investors have a convenient and accessible way to invest in a diversified portfolio that could potentially provide higher returns than individual securities. However, investors should also take into account the potential risks and fees associated with mutual fund investments.

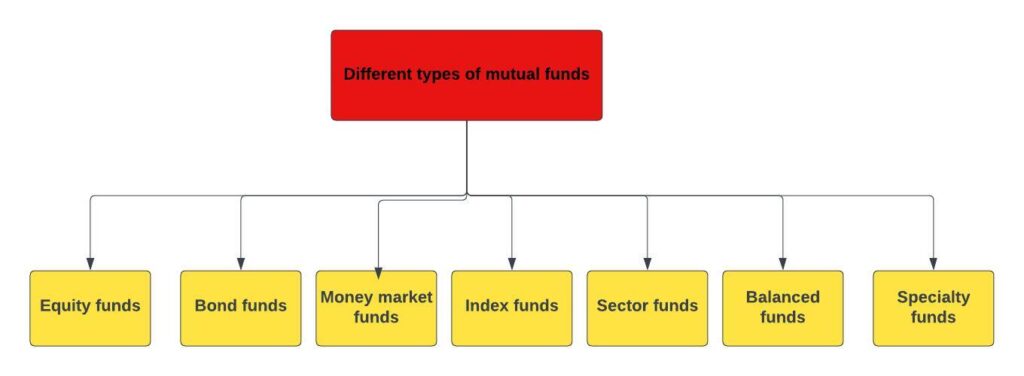

What are different types of mutual funds?

Mutual funds come in several types, each with unique investment objectives, strategies, and risks. Common types of mutual funds include equity funds, bond funds, money market funds, index funds, sector funds, balanced funds, and specialty funds.

Equity funds: Equity funds invest in stocks or other equity securities and are considered higher risk due to stock market volatility.

Bond funds: Bond funds invest in fixed income securities such as bonds and are generally lower risk than equity funds, but may offer lower returns.

Money market funds: Money market funds invest in short-term debt securities such as government bonds and provide a low-risk option for investors seeking stability.

Index funds: Index funds track a specific stock or bond index, such as the S&P 500, and offer a low-cost way to invest in a diversified portfolio.

Sector funds: Sector funds focus on a specific sector or industry, such as technology or healthcare, and may offer higher returns but also come with higher risks.

Balanced funds: Balanced funds invest in a mix of stocks, bonds, and other assets to balance risk and return.

Specialty funds: Specialty funds invest in unique or alternative assets, such as real estate or commodities, offering diversification but also added risks.

Why invest in mutual funds?

Diversification: Mutual funds provide a diversified portfolio of assets, which can help to spread the risk and minimize the impact of individual securities on overall portfolio performance.

Professional management: Mutual funds are managed by professional fund managers who have expertise in selecting and managing investments. This is particularly beneficial for investors who lack the time or knowledge to manage their own portfolio.

Accessibility: Investors can purchase mutual funds with relatively low investment minimums through brokerage firms or directly from fund companies, making them easily accessible.

Liquidity: Investors can buy or sell their shares in mutual funds at any time at the current market price, making mutual funds generally considered as liquid investments.

Potential for higher returns: Mutual funds have the potential to generate higher returns than traditional savings accounts or fixed-income investments over the long term, although there are no guarantees.

What is Systematic Investment Plans (SIP)?

Mutual funds offer investors a systematic investment plan (SIP) strategy that enables them to make fixed, regular investments over time instead of a lump-sum investment all at once. With this strategy, investors can invest a specific amount of money at regular intervals, such as monthly or quarterly, into a mutual fund of their choice. SIPs are popular in India and other countries, as they allow retail investors to invest in mutual funds regularly without timing the market.

One benefit of SIPs is that they enable investors to benefit from the power of compounding and reduce the impact of market volatility on their investments. This investment strategy can effectively help investors build wealth over time while managing risk. Nevertheless, as with any investment strategy, there are risks involved, and it is important for investors to carefully consider their financial goals and risk tolerance before investing in SIPs.

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein.