In Stock Market Today, Nifty concluded the day nearly at the 22,400 mark, while the Sensex wrapped up with marginal increases.

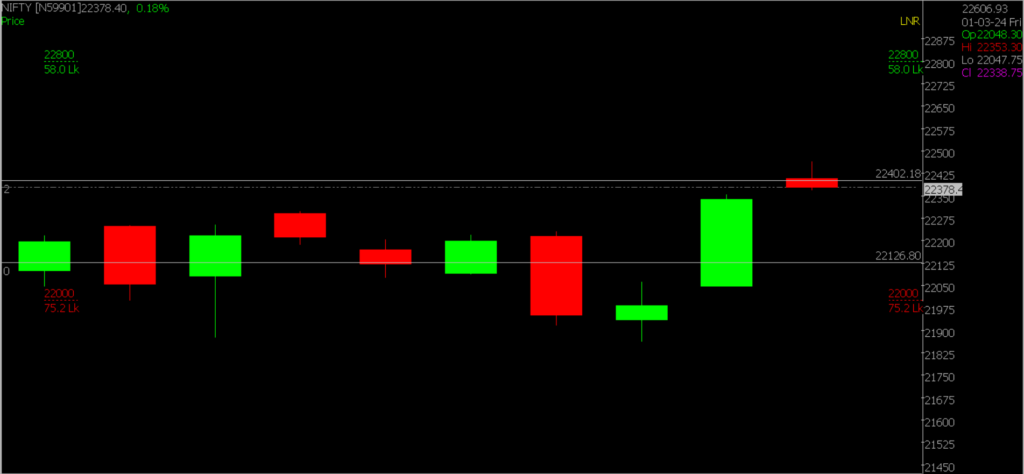

Stock Market Nifty Chart Prediction.

During a special trading session today which is March 2, the Nifty soared to a new record high, breaching the 22,400 level for the first time. Following suit, the Sensex also reached a fresh peak, edging closer to the 80,000 mark.

Encouraging cues from global markets and widespread gains across various sectors fueled the market’s momentum.

The Sensex closed +60.80 points higher, registering a +0.08 percent increase at 73,806.15, while the Nifty climbed by +37.50 points, representing a +0.17 percent rise, to settle at 22,376.30.

Stock Prediction for 04th March 2024.

| STOCK | Good Above | Weak Below |

| ADANIPORTS | 1351 | 1332 |

| BPCL | 630 | 618 |

| CIPLA | 1502 | 1480 |

| HEROMOTOCO | 4622 | 4556 |

Prediction For Monday, NIFTY can go up if it goes above 22,400 or down after the level of 21,130 but all depends upon the Global cues.

Facing downward pressure after initially starting the day with gains, the Nifty concluded at its lowest point. Despite this, the overall sentiment remains upbeat, with the index needing to exceed the 22,400 threshold to initiate a fresh uptrend. A firm breach past 22,400 could potentially drive the index towards 22,800. Conversely, support levels are identified around 22,130-22,000 on the downside.

| Highest Call Writing at | 22,400 |

| Highest Put Writing at | 22,130 |

Nifty Support and Resistance

| Support | 22,130, 22,000 |

| Resistance | 22,400, 22,800 |

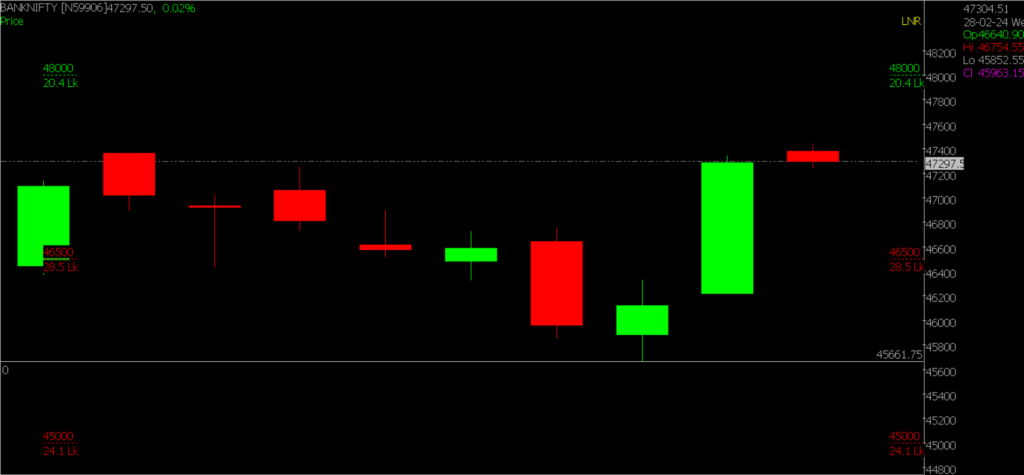

Bank Nifty Daily Chart Prediction.

Prediction For Monday, Bank NIFTY can go up if it goes above 48,000 or down after the level of 46,500 but it all depends upon the Global cues.

The momentum of Bank Nifty has been strengthening, indicating potential for further gains. Immediate resistance lies at 48,000; a breakthrough above this level could propel the index towards 48,500. Conversely, a robust support zone is anticipated between 46,500 and 45,660 on the downside.

| Highest Call Writing at | 48,000 (20.4 Lakhs) |

| Highest Put Writing at | 46,500 (28.5Lakhs) |

Bank Nifty Support and Resistance

| Support | 46,500, 45,660 |

| Resistance | 48,000, 48,500 |

Also, learn what a Shooting Star Candlestick Pattern indicates.

If you’d like to know how we analyze the market and provide accurate levels every day. then click on the Free Demo button below and change your trading life for good. 5X returns are possible in options trading If you have Spider Software in your trading system.

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein.