In Stock Market Today, Near 22,400, Nifty concludes; Insurance stocks see a surge of +1-3%, while wind players witness a slump of -3-5%.

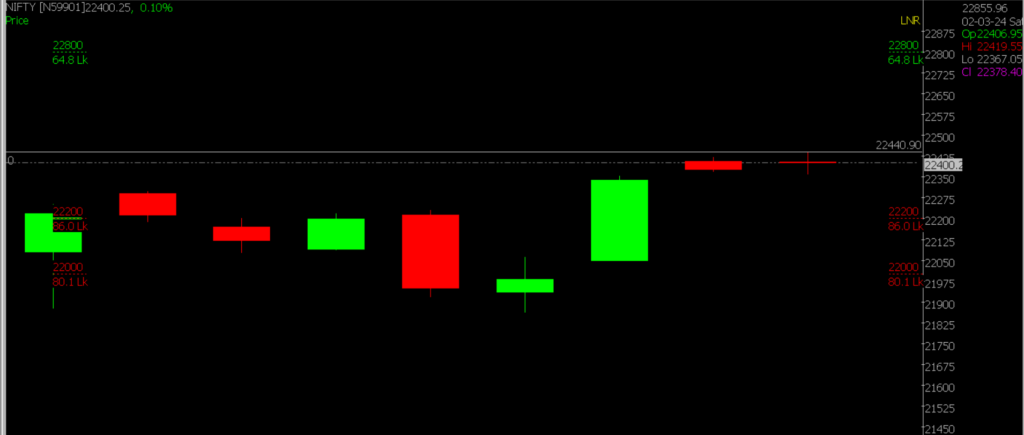

Stock Market Nifty Chart Prediction.

The Nifty reached 22,405.60, up by +27.20 points or +0.12 percent; whereas, Sensex stood at 73,856.05, up by +49.90 points or +0.07 percent.

Among the sectors, banks, energy, infra, and pharma witnessed gains, whereas

information technology, metals, FMCG, and automobile faced pressure.

Top gainers were NTPC, HDFC Life, and Power Grid,

while JSW Steel, Eicher Motors, and M&M experienced significant declines.

Stock Prediction for 05th March 2024.

| STOCK | Good Above | Weak Below |

| IGL | 451 | 446 |

| DLF | 938 | 928 |

| DRREDDY | 6360 | 6300 |

| GRANULES | 473 | 467 |

Prediction For Tuesday, NIFTY can go up if it goes above 22,440 or down after the level of 22,200 but all depends upon the Global cues.

With a consolidated move, Nifty began the week, forming a Doji candle on the daily chart. Despite this, the bullish sentiment prevails. Anticipating a decisive break above 22,440 to enhance momentum, targeting 22,800 on the upside. Support is set at 22,200, offering buying opportunities during pullbacks to this level.

| Highest Call Writing at | 22,440 ( 64.8 Lakhs) |

| Highest Put Writing at | 22,200 (86.0 Lakhs) |

Nifty Support and Resistance

| Support | 22,200, 22,000 |

| Resistance | 22,440, 22,800 |

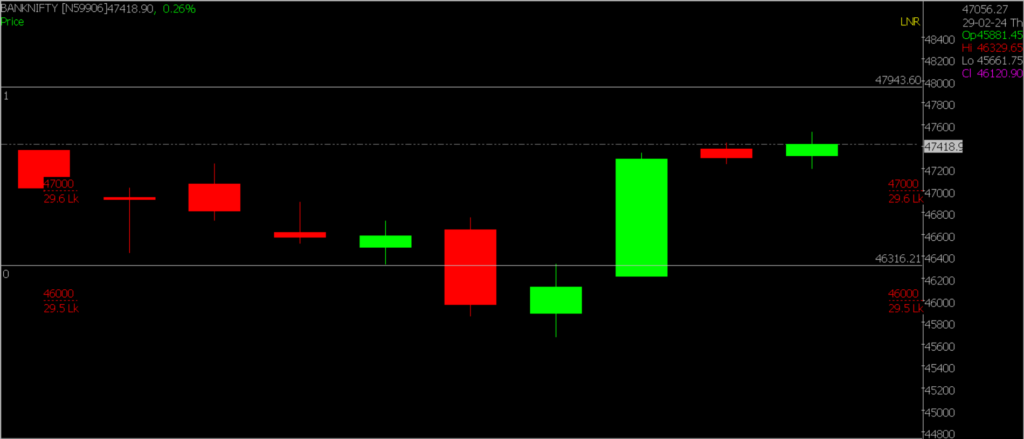

Bank Nifty Daily Chart Prediction.

Prediction For Tuesday, Bank NIFTY can go up if it goes above 47,490 or down after the level of 47,000 but it all depends upon the Global cues.

Demonstrating resilience, the Bank Nifty index sustained strength, staying above the critical support level of 47,000. “The index remains bullish, with the possibility of reaching new all-time highs soon. Immediate resistance lies at 47,940, and a breakthrough above this level is expected to accelerate momentum towards potential lifetime highs, possibly around 49,000.

| Highest Call Writing at | 47,490 (30.3 Lakhs) |

| Highest Put Writing at | 47,000 (29.6Lakhs) |

Bank Nifty Support and Resistance

| Support | 47,000, 46,320 |

| Resistance | 47,940, 49,000 |

Also, learn what a Shooting Star Candlestick Pattern indicates.

Join our upcoming webinar on Strategies for Options: Iron Condor and Iron Fly.

If you’d like to know how we analyze the market and provide accurate levels every day. then click on the Free Demo button below and change your trading life for good. 5X returns are possible in options trading If you have Spider Software in your trading system.

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein.