In the Stock Market Today, Nifty closed near 19700 and Sensex ended 140 points lower. Strong performance by the IT Sector.

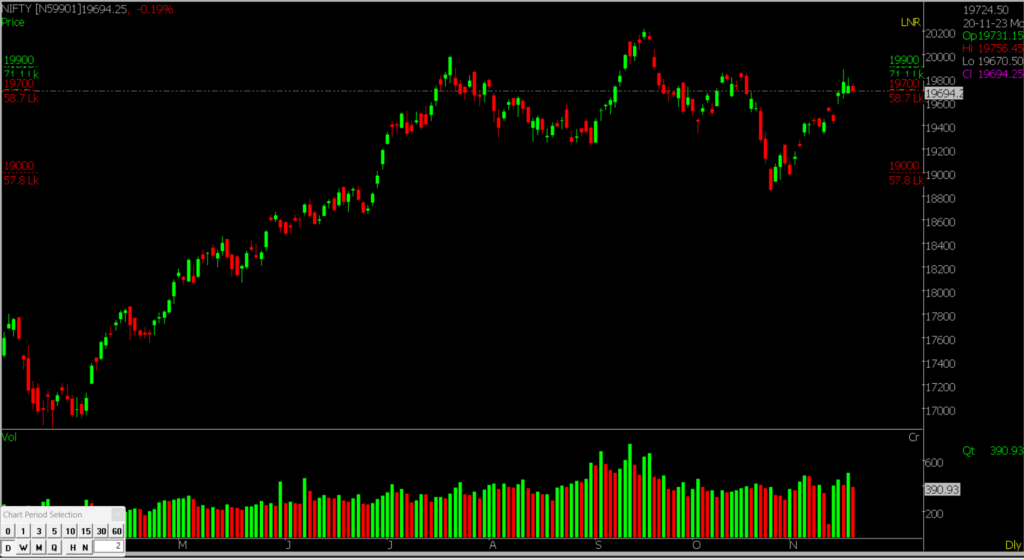

Stock Market Nifty Chart Prediction.

On November 20, benchmark indices experienced a second consecutive decline, with the Nifty hovering around 19,700. The Sensex closed lower by 139.58 points (0.21%) at 65,655.15, and the Nifty was down 37.80 points (0.19%) at 19,694.

Among the Nifty top losers were Adani Enterprises, M&M, Bajaj Finance, SBI Life Insurance, and UltraTech Cement, while gainers included Divis Labs, Bharti Airtel, HCL Technologies, Wipro, and ONGC.

The Information Technology index rose by 0.6%, and the Healthcare index increased by 0.3%. Conversely, selling pressure was observed in the metal, auto, capital goods, FMCG, and realty sectors. The BSE midcap index remained flat, while the smallcap index saw a 0.4% rise.

Prediction For Tuesday NIFTY can go up if it goes above 19800 or go down after the level of 19500 but it all depend upon the Global cues.

The market is likely to remain steady, considering that today it opened at the same level and experienced a brief upward movement without surpassing Friday’s high. Subsequently, it retraced to the 19,680 to 19,700 range and consistently consolidated within that zone until the closing. Any movement beyond the specified levels could lead to a one-sided move, either upwards or downwards. If Nifty opens flat, there’s a possibility it may reach the levels of 19,800 or 19,500. However, these scenarios are contingent on global cues.

| Highest Call Writing at | 19800 (1.2 cr) |

| Highest Put Writing at | 19500 (57.8 Lak) |

Nifty Support and Resistance

| Support | 19500, 19450 |

| Resistance | 19800,19850 |

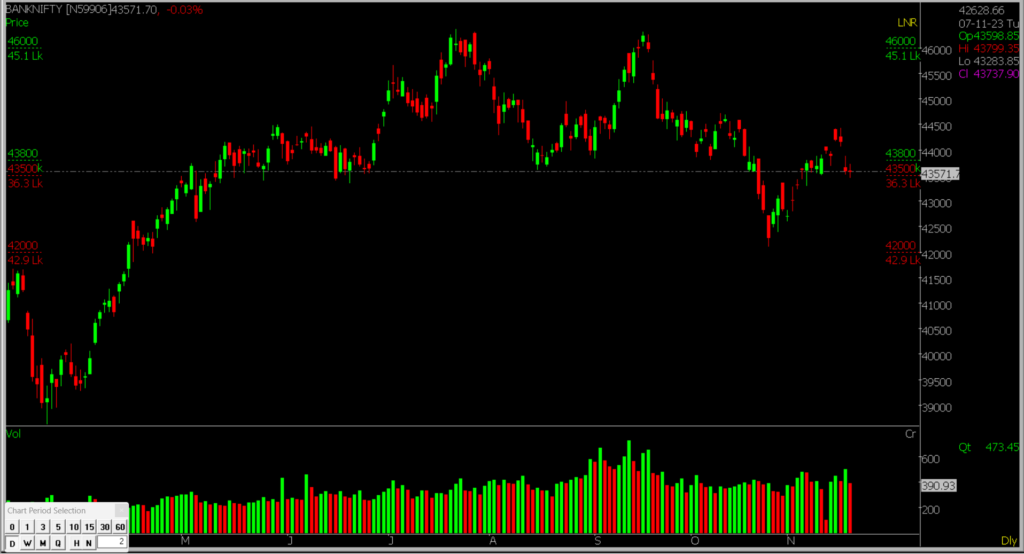

Bank Nifty Daily Chart Prediction

Prediction For Tuesday Bank NIFTY can go up if it goes above 43700 or go down after the level of 43500 but it all depends upon the Global cues.

Today, Bank Nifty opened Flat at 43,591.50 versus Friday’s close of 43,583.95. Presently, it stands at 43,670, marking a modest increase of 0.2 percent. The index maintains a bullish bias with a favorable advance/decline ratio of 9/3. Punjab National Bank is the top gainer, showing a 1.7 percent increase, while IDFC First Bank is the leading loser, experiencing a 0.7 percent decline. During the morning session, Bank Nifty initially dipped, retraced to 43,500, and then surged, forming a double-top pattern in a 5-minute Intra-day chart. Despite reaching the day’s high twice, it eventually retreated towards the 43,500 level, finding support and fluctuating within the range of 43,680 and 43,500.

| Highest Call Writing at | 43700 (38.9 Lak) |

| Highest Put Writing at | 43500 (36.3 Lak) |

Bank Nifty Support and Resistance

| Support | 43700 |

| Resistance | 43500 |

Also, check our Article on Elliott Wave Patterns.

If you’d like to know how we analyze the market and provide accurate levels every day. then click on the Free Demo button below and change your trading life for good. 5X returns are possible in options trading If you have Spider Software in your trading system.

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein.