The EV sector is a thriving industry that promises to reshape transportation with eco-friendly and high-performance solutions. Discover why adding EV sector stocks to your portfolio can unlock exciting opportunities for long-term growth and sustainability.

Since humanity invented the wheels, modes of transportation have undergone several changes. Therefore, with the passage of time, the automotive industry also had to make dynamic and proactive changes every now and then to capture the depth of its target market and expand its customer base.

The automotive sector in India is experiencing technological changes with the arrival of electric cars. However, compared to developed countries, distribution and innovation in EV technology in India is at a very promising stage. So it seems like an attractive opportunity for investors who want to invest in the future of the automotive industry.

Industry Insight of EV Sector.

The automobile industry contributes around 7.5% to India’s GDP and a whopping 49% to manufacturing GDP, which has a significant impact on the economy. This means that as the EV industry grows and gains in popularity, several ancillary automobile and related industries will experience growth as well, provided they can keep up with the trends.

In 2020, India was the largest producer of tractors and the second largest producer of buses as well as the largest producer of 2W AND 3W globally. Vehicle penetration is expected to reach 72 vehicles per 1,000 people by the end of 2025. India accounts for 40% of the total US$31 billion spent on engineering and research and development worldwide. 8% of the country’s R&D spending is on the automotive industry.

Why to consider EV stocks?

Electric cars have been gaining huge popularity recently due to their ability to reduce harmful emissions and prevent the depletion of natural resources. In fact, India has witnessed a significant increase in EV sales, with 11,70,916 units being purchased in FY 2022-23 alone, crossing the million milestone for the first time in a fiscal year.

With the electric vehicle market size in India forecast to reach a whopping $113.99 billion by 2029 and growing at an impressive CAGR of 66.52%, it’s no surprise that EV stocks in India are currently trending.

EV stocks are undoubtedly your hot bait if a real-time investor looking for a credible industry to invest in. The EV stock boom in India allows you to prosper financially even during a market downturn.

Top 5 Stocks to invest in EV sector.

1. TATA Motors.

Market Cap =₹1.97 Trillion CMP =₹535.20 1-Year return =20.36% 5-Year return =72.9%

Tata Motors Limited is an international car manufacturer. The company’s diverse portfolio includes various passenger cars, sport utility vehicles, trucks, buses and defense vehicles. Its segments include automotive operations and other operations. It is one of the oldest car manufacturers on the market. So far they offer 3 different electric vehicles in India: Tata Nexon EV Prime, Tata Nexon EV Max and Tata Tigor EV.

2. Mahindra & Mahindra.

Market Cap =₹1.58 Trillion CMP =₹1341.40 1-Year return =26.84% 5-Year return =47.26%

Mahindra & Mahindra has the largest electric car portfolio in India under one corporation. The company offers both private and public transport options. The product range includes the eVerito & e20 Plus for private drivers and fleets and the eSupro, eAlfa Mini, Treo and Treo Zor in the public transport segment. They entered the electric vehicle sector in 2022 with their XUV400. Reservations for this electric vehicle from M&M began in January 2023. The large-cap stock has a profitability score of 7.1/10 on Scorecard, which is only available with a Pro subscription. The market cap of Mahindra & Mahindra is ₹1.58tr and the current market price of this share is ₹1328.50. The 1-year return of this stock is 26.84% and 5-year return of this stock is 47.26%.

3. Amara Raja Batteries

Market Cap =₹106.15 Billion CMP =₹614.45 1-Year return =21.8% 5-Year return =-21.86%

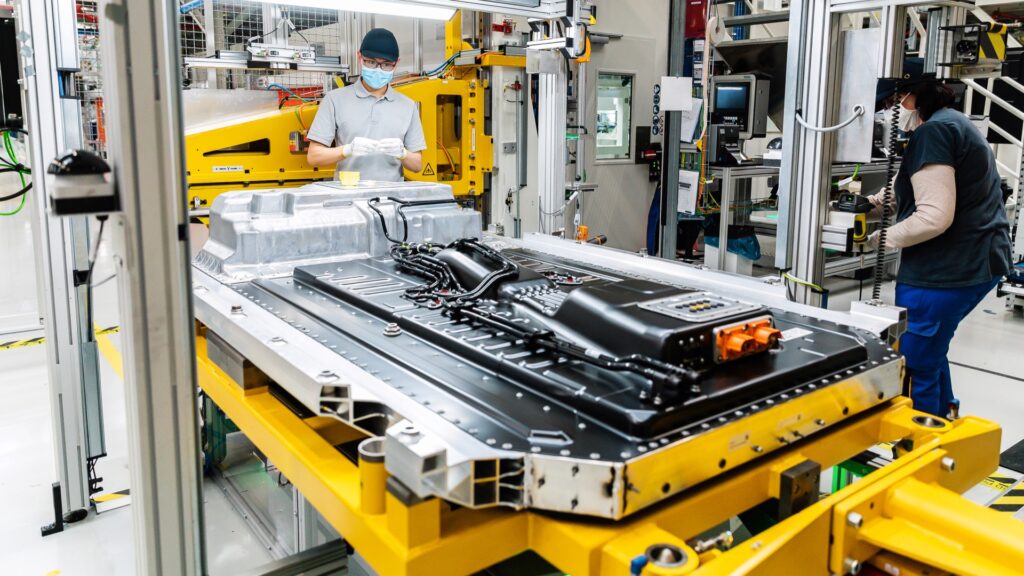

Amara Raja Batteries Limited, the flagship company of the Amara Raja Group and maker of Amaron batteries, is the largest manufacturer of automotive batteries in India. The company also has a strong presence internationally, with greater influence in the Asia-Pacific region. It plans to build a Giga factory in the next five to eight years with an investment of $800 to $1 billion. The company established the only technology centre in the country for the development of lithium-ion cells.

4. Olectra Greentech

Market Cap =₹62.53 Billion CMP =₹734.70 1-Year return =29.77% 5-Year return =380.67%

A subsidiary of Megha Engineering and Infrastructures Ltd. The company has a solid foundation in electric bus production, with the K9 variant boasting a regenerative braking system that saves 30% of braking energy and faster charging systems. In addition, the company is the only manufacturer of electric Tarmac buses used in Indian airports.

5. Sona BLW Precision Forgings

Market Cap =₹266.9 Billion CMP =₹530.20 1-Year return =-6.44% 5-Year return =45.87%

It is an Indian origin, global manufacturer of automotive systems and components with 9 plants in India, China, Mexico and USA. The company is one of India’s leading automotive technology companies that designs, manufactures and supplies highly engineered, critical automotive systems and components in the US, Europe, India and China, across all vehicle categories such as conventional passenger vehicles, commercial vehicles, off -highway. vehicles, electric cars, electric light commercial vehicles and electric two-wheelers and three-wheelers.

Conclusion

The EV sector is evolving rapidly and India can expect several new players to enter the market. However, as an investor, it is always advised to do your research before investing in any stock.

Also, Check our article on TRADING PSYCHOLOGY – The most important aspect of Trading?

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Spider Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Spider Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein.